In recent weeks we’ve fielded questions from a number of different parties about a mysterious jump in Queensland demand that some have observed late in 2014.

Pitts & Sherry in this Cedex report for January note that:

“Demand would have been even lower, were it not for the sharp increase seen in Queensland. The data suggest that this is entirely attributable to a very large new continuous industrial load of around 400 MW, which came on line on 27 October. The identity of this load appears, surprisingly, to be commercial in confidence. It is about the same size as either one of the two recently closed aluminium smelters. In a full year, a load of this size would add about 3.5 TWh to annual electricity demand, equal to almost 2 % of current NEM demand and over 7% of Queensland demand prior to its connection.”

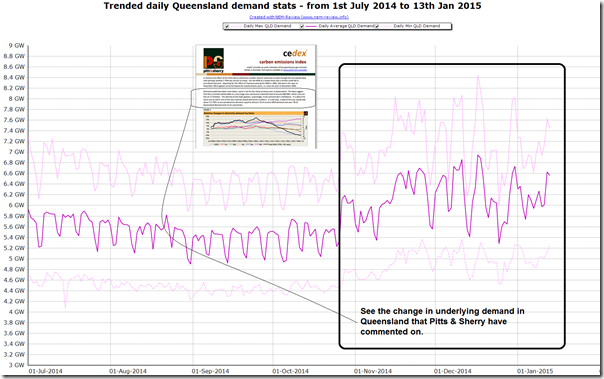

Hugh Saddler (of Pitts & Sherry) also added a question for WattClarity readers in the comments on this post. For those without the same ability, the following trend from NEM-Review of daily demand extremes in Queensland shows the change described:

We’ve begun a process of digging further, to see what we can find – this we will fit in with other priorities, so an answer won’t be immediate.

If you (also) would like to hear of the results of our ongoing analysis, please email through to let us know. Depending on what we find (and how many are interested), we might share some of our findings on WattClarity – or we might just share them privately with interested parties.

Of course – if you already know what the answer is, and are happy to share with us, then let us all know by leaving a comment below!

Could it be the gas liquefaction plant near Gladstone?

That’s one possibility, Craig – especially when thinking about the broader LNG supply chain, including upstream electric compression (as noted here). We’ll wait to see what our further investigations reveal, in terms of size and timing.

Several of the process diagrams for LNG trains show that the compressors are driven by gas turbines (costly?). Also, if they were consistently running the liquefaction plant could they store all the LNG? Surely someone can confirm or deny the rumours!

My personal opinion is that the unique G20 public holiday in November caused a step change in southeast Queensland customer behaviour. The pristine weather before the supecell hailstorm was just the right time to head to the Gold/Sunshine coasts and drive up the tourism load. Also the early holiday could have driven consumers into tropical summer holiday mode earlier than usual, turning on the air conditioning earlier than would otherwise have been the case.

Thanks Peter – that’s certainly a different theory 🙂 – I, for one, can’t recall what I was doing on the G20 holiday!

An AEMO Market Notice on 26 September 2014 said that the second 275/132 kV transformer at PowerLink’s new Wandoan South substation was commissioned.

Then there’s APLNG Columboola and the PowerLink Orana 275 kV substation that feeds APLNG there.

See also http://www.originenergy.com.au/files/APLNG_Project_Upstream_Delivery.pdf

So my guess is that the mystery customer in APLNG.

PS: I wouldn’t burn my valuable natural gas to make electricity for my compressors if I can buy cheaper electricity from a coal fired power station 🙂

On the other hand http://www.originenergy.com.au/files/APLNG_Site_Tour_Combined_Presentations.pdf says that the APLNG plants near PowerLink’s Columboola and Orana substations are only good for less than 100 MW 🙁

Thanks for the great links Mike. They also built two 30 MW gas power stations in the area (pg. 17). It’s probably not too expensive if you run them on unprocessed gas and it would give them a bit more flexibility in managing gas supply vs. demand.

Pretty sure its just the start of summer, it has been hot and humidity has been up. There aren’t any regional loads that are up significantly apart from the gradual growth in the Surat. The real demand in QLD still has a while until it hits.