Transformation in the electricity industry is occurring at an astounding rate. What’s more, it’s happening globally and Australia is pretty much ground zero. As a result, a new energy ecosystem is emerging. Accenture has recently released three reports which cover different aspects of this new ecosystem. These are the ‘New Energy Consumer’ report, ‘Digitally Enabled Grid’ report and the combined report for the ENA and CSIRO titled ‘Insights from Global Jurisdictions and Evolving Business Models’.

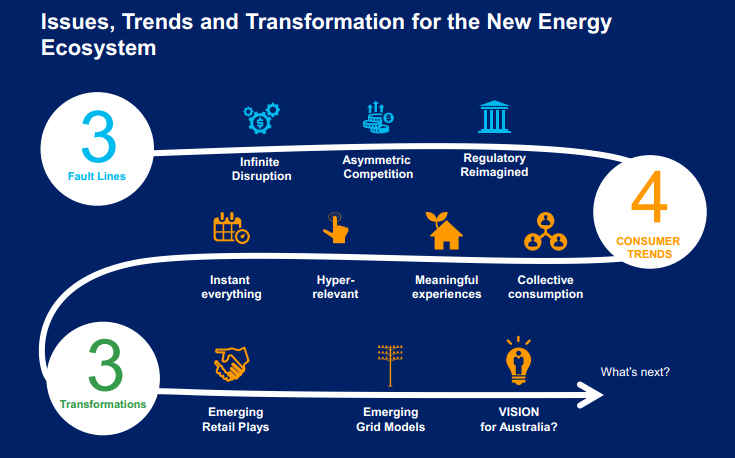

As a summary, these reports show the new energy ecosystem and how it can be explained by three seismic shifts, four consumer trends and three broad transformations that the Australian industry should take strong interest in. Just remember three-four-three.

Three seismic shifts

Infinite disruption, asymmetric competition and ‘regulatory reimagined’ make up our three seismic shifts.

Conceptually, disruption is infinite because it never stops, you can’t outflank it and more often than not, you can’t see it coming. There is disruption to demand because it is static or declining around the world (even where peak demand is not). This is leading to a huge decoupling of revenue from consumption, for example Mojo selling energy at wholesale rates and charging a subscription.

Then there is disruption from technologies. Platforms are popping up everywhere. The Internet of Things and intelligent automation are hot topics. Blockchain (a technology that was anticipated to make waves in the financial sector) is now becoming a disruptive force in the energy space. An example is New York-based Transactive Grid which is a community energy market enabled by blockchain. Transactive Grid enables the buying and selling of electrons using a transaction database that is replicated and synchronised across multiple locations. Similarly, artificial intelligence (AI) is also making waves in the energy sector. Flipper is a UK-based AI platform that learns consumer habits and finds the cheapest utilities according to personal needs.

Asymmetric competition means that new players emerging overnight, from both within the energy industry, as well as other industries. Powerpeers for example, is a new business in the Netherlands owned by energy provider Vattenfall. Referred to as the ‘Air BnB’ of energy, it enables consumers and prosumers to contract directly with one another, providing a localised exchange of energy and enabling full energy traceability. Similarly in Australia, Telstra has even started its own energy division. Though Telstra is a telecommunications provider, it is leveraging its capabilities to enter the electricity market with a bundled value proposition.

The ‘reimagining of regulation’ is happening across the world. One of the most prominent examples is New York’s ‘Reforming the Energy Vision’ (REV) program. They are overhauling the entire system with changes in current regulatory, tariff and market designs and incentive structures. The trend is towards market-based reform but the trick is how to get them functioning correctly when the basic provision of electricity is an essential service and must be achieved leaving little room for market based fluctuations.

Four consumer trends

Combine these disruptions with the transformational attitudes of today’s digital consumers and you can understand the challenge facing energy providers in this rapidly evolving market.

As discovered in Accenture’s recent New Energy Consumer study, millennials will be the largest energy consuming cohort by 2020, and will shape the way utilities of the future deliver their products. According to the New Energy Consumer study, 75 per cent of Australian millennials are likely to consider switching to a different energy provider if their energy provider is not able to provide a seamless experience.

Millennials are characterised by four consumer trends:

- Instant everything – they want services that are fast, simple and effortless. There is no such thing as delayed gratification anymore, as evidenced by the likes of PayPal and Amazon Prime. They now expect similar speed and gratification from all organisations they interact with.

- Hyper-relevant experiences – Millennials want everything to be highly customised and relevant. They want personalised interactions and experiences that align with their lifestyle.

- Meaningful experiences – Purchasing energy is now a meaningful experience – it’s an expression of ‘who I am’ and this is shared with everyone. Purchasing energy demonstrates passion and environmental and social value, which is a trend pointing to the need for intangible branding, which goes far beyond product value.

- Collective consumption – Finally, millennials want to share and be part of a community, they are less interested in owning things. This trends is what community based peer-to-peer energy trading models are tapping into.

Customer strategies must take a broad view of the trends shaping today’s consumers, and more importantly, the consumers of tomorrow. Millennials are the most important cohort, must be taken seriously and business models need to adapt to meet their needs.

Three transformations moving forward

Seismic shifts and consumer trends are changing business models most importantly in the retail and network operator industry.

As such, we see three emerging retail plays. Energy providers can look to become a commodity centric supplier, an energy marketplace enabler (that links all of the best new technologies together and provides personalised services) or a connected lifestyle provider (which provides peer to peer energy models.)

From a grid perspective we see the Distribution Platform Optimiser model dominating all outcomes. This means that the role of network operators will evolve towards one which not only integrates and connects DERs but optimises DER capacity in a time and location manner to provide the optimal outcome for the overall system. If done well the grid can be optimised by the strategic use of distributed generation – helping to balance demand and supply and defer costly capital upgrades.

This model would also require a new role – a ‘Distribution System Operator’ which would manage and coordinate interactions between the distribution and the wholesale market.

The ultimate outcome of this would be that thousands of battery storage, solar, community wind and CHP units would be incentivised and optimised for grid stability – aligning DG owners and the grids’ interests while at the same time lessening volatility on the wholesale market.

In our recent ENA and CSIRO study we looked at 7 of the more interesting global jurisdictions. We studied their drivers for change, market and infrastructure capabilities and their ambitions as described by their major reform programs. What struck us was the ambition of some of these areas.

New York especially but also California and the Netherlands all have sophisticated highly ambitious transformation programs. From an Australian perspective, we see it as inevitable that we will take a similar approach and consolidate many of our incremental reforms into a larger transformation program with a longer term vision. Perhaps this will be an Oz REV – An Australian ‘Reforming the Energy Vision’ program

Finally, for Australian energy providers to be successful it’s important to have a coherent understanding of the industry’s changing dynamics and a sense of global perspective and master the three-four-three.

About our Guest Author

|

Simon Vardy is a Melbourne based management consultant leading Accenture’s utilities strategy practice in Australia.

Simon advises clients on business transformation including corporate strategy, operational and go-to market strategies, regulatory, public policy and consumer engagement issues. Simon works with some of Australia’s leading energy and utility companies (electricity, gas and water), government departments and industry associations. Further background to Simon can be found on Simon’s LinkedIn profile. |

“The ultimate outcome of this would be that thousands of battery storage, solar, community wind and CHP units would be incentivised and optimised for grid stability – aligning DG owners and the grids’ interests while at the same time lessening volatility on the wholesale market.”

Nice powerpoint. I sat through many of these types of presentations in a long IT career. Everything would be integrated and optimised into a smoothly working environment. Never really happened. Now looking at the evolving power industry and the desire to have vastly distributed, non standardised equipment purchased by individuals, community groups and companies all interconnected, playing well together and optimised for grid stability. I do believe the extent of challenge is understood, or perhaps its not acknowledged because it doesn’t fit the desired narrative.

Small example, we have had our house with smart meter for 4 years. Even though one organisation controls the equipment, the standards, the deployment etc and gets penalised for non delivery, they still have not deployed remote metering (coming real soon they say). That is a relatively simple project , albeit with large scale. Integration of 1000s of disparate systems, with fine control to deliver grid stability, when you don’t control all the levers seems to be a courageous goal Minister.