There was some early morning price action in the South Australian region on Monday 8th December 2025, as captured here at the time:

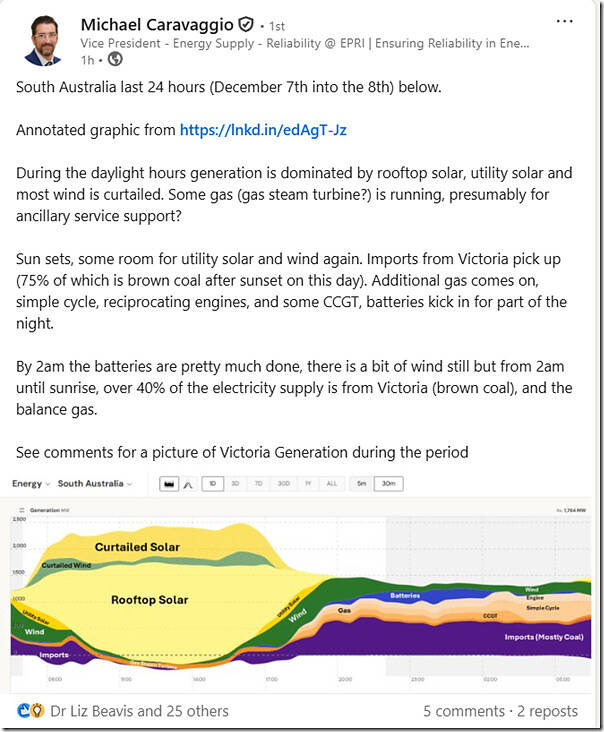

Ordinarily, I’d probably not post about this, but (coincidentally) happened to notice that the overnight period in South Australia came to the attention internationally, with Michael Caravaggio from EPRI posting this on LinkedIn:

In Michael’s update:

1) The chart shows (at the right-hand end) the same time-range as the price spikes, but did not include the price blips.

2) Michael’s infers that the battery state of charge is low from ~02:00 (i.e. when output from BESS drops).

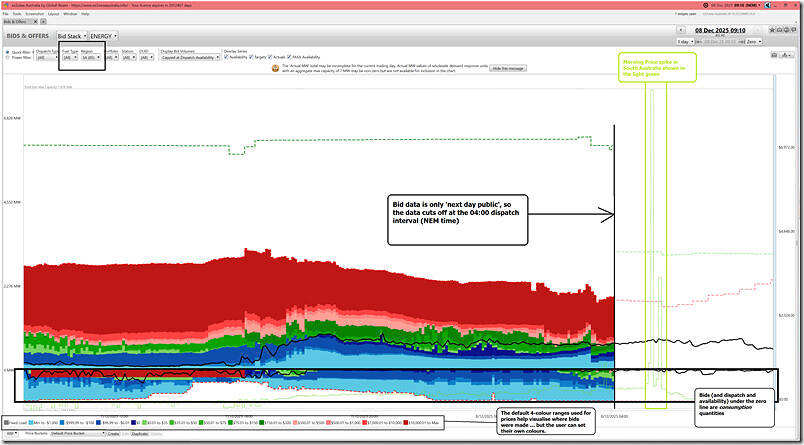

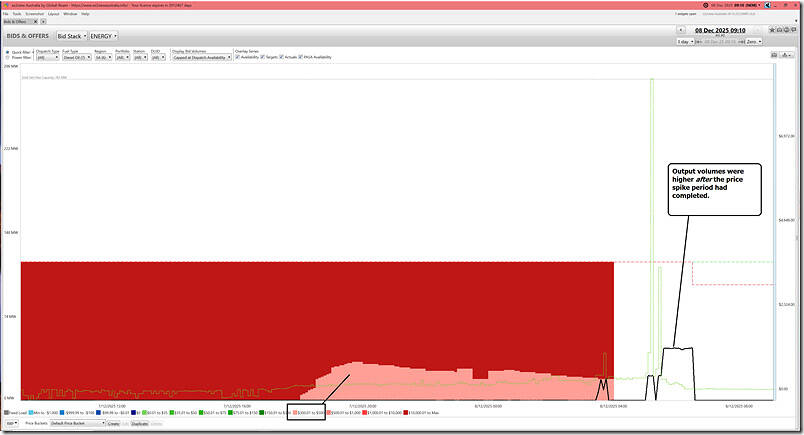

Aggregate ‘Bids & Offers’ widget view for all units in South Australia

Now, 05:00 to 05:30 (the period of the price spike, NEM time) is in the ‘current day’ period (i.e. after the 04:00 cut-off for the prior market day) … but it’s not long after 04:00 so I thought it would be useful to include this series of charts from the ‘Bids & Offers’ widget in ez2view, filtered down to South Australia with a focus on various fuel types in sequence.

Note that, whilst we can’t see bids (not until tomorrow) for the price volatility period, that’s clearly not going to stop readers here visually extrapolating in their heads to what might have happened beyond 04:00

Let’s start with a summary view of all units in South Australia using the ‘Bids & Offers’ widget in ez2view which looks back 24 hours from the 09:10 dispatch interval (NEM time):

I won’t try to copy out the annotations on this image, intended to help those readers here who are not so familiar with our ez2view software.

Filtering the ‘Bids & Offers’ widget view by fuel type

Now let’s further filter the window above by various fuel type.

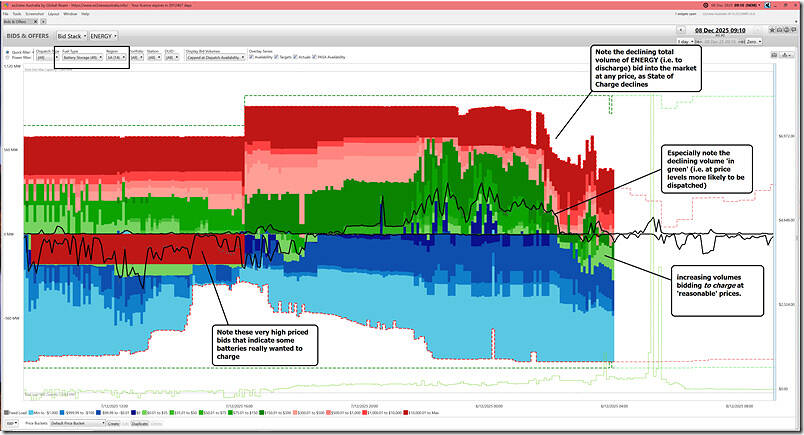

the ‘Bids & Offers’ widget view (for Batteries)

Given the broader interest in batteries, we’ll start here:

Note that (following the IESS rule change and the advent of bi-directional units (BDUs), bids for consumption are under the line. We can see:

1) Declining volume to discharge at any price from ~02:00 in the morning (i.e. around the time

(a) but importantly also note that the volumes available were also bid out of ‘green’ and into more pink and red volumes (i.e. at higher prices)

(b) these two moves contributed to lower discharge volumes from batteries.

(c) … which aligns with Michael Caravaggio noting that ‘By 2am the batteries are pretty much done’

2) What’s also notable is that (in parallel), battery consumption was bid further up the price stack, showing a keenness to re-charge during the period from ~02:00 to 04:00

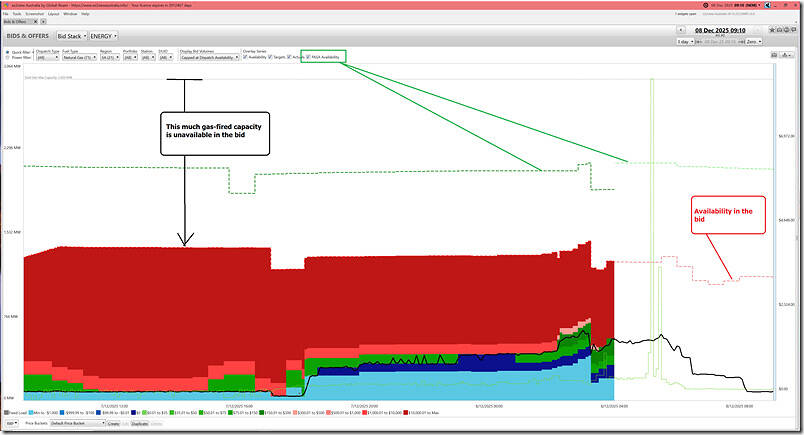

the ‘Bids & Offers’ widget view (for Gas-fired units)

Here’s the analogous view, for the gas-fired units that remain active in South Australia (noting there are several units that have retired in recent years):

We can see that, in broad terms, the volume of gas-fired generation dispatched was largely dictated by the volume bid in ‘blue and green’ overnight … remembering that there’s been a lower volume of capacity bid in green in recent years.

the ‘Bids & Offers’ widget view (for Liquid-fired units)

There’s a couple more expensive liquid-fuelled units in South Australia, seen here:

As a curiosity, note that the output of these units peaked after the volatile period was done.

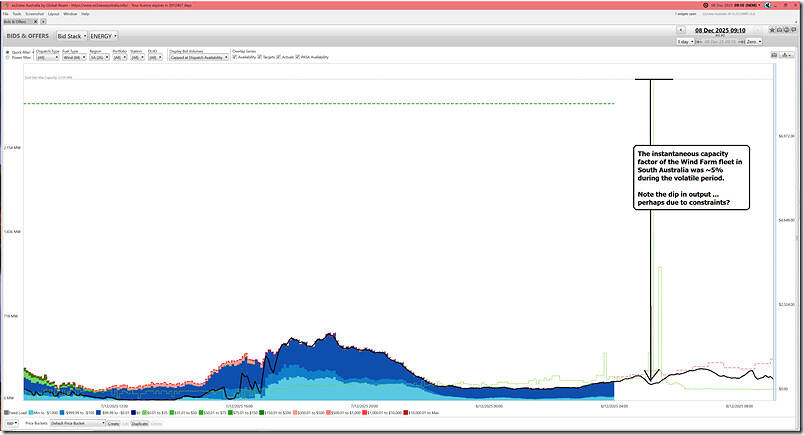

the ‘Bids & Offers’ widget view (for Wind Farm units)

Moving now to the Semi-Scheduled units, we take a first look at the Wind Farm units in South Australia:

From this image, we see:

1) This 24 hour period was one seeing low wind capability across the wind farm fleet in South Australia (i.e. a peak instantaneous capacity factor of ~20%)

2) During the peak price period, we see that

(a) the instantaneous capacity factor was down at only ~5%

(b) and that there’s a dip in output from at least some of the wind farms … which may have been due to network curtailment.

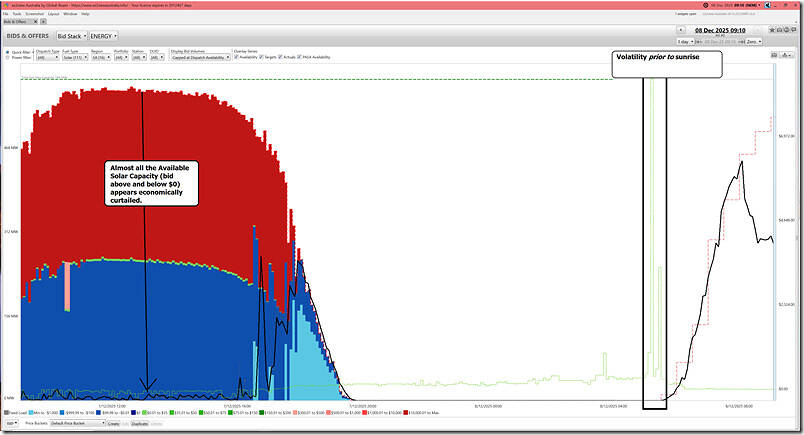

the ‘Bids & Offers’ widget view (for Solar Farm units)

Let’s finish off with the Semi-Scheduled Solar Farm units in South Australia:

With this image we see:

1) For the period of volatility on Monday morning 8th December 2025, the sun’s not yet risen (though not too far away) so no contribution to supply from these Large Solar units

2) But also worth noting what happened on Sunday 7th December 2025:

(a) We see almost all the available Large Solar generation ‘economically curtailed’ due to the depressed prices through the day

(b) Which we already showed (in the NEMwatch snapshot in the article ‘Actual MSL2 in South Australia (not the first time) on Sunday 7th December 2025’ at the time) was due to (mostly inflexible) rooftop PV crushing everything* else in its path

* with the exception of the lone thermal unit still required for system strength.

Be the first to comment on "Early morning price volatility in South Australia on Monday 8th December 2025"