Editor’s Note: Ben has adapted this article from a presentation he gave at the Australian Wind Industry Forum in Melbourne on Tuesday, 6th May 2025. In it, he explores the multiple contracting routes available for renewables and storage, and how project business cases are increasingly stacking these together.

The long-term OTC contract market is rapidly changing.

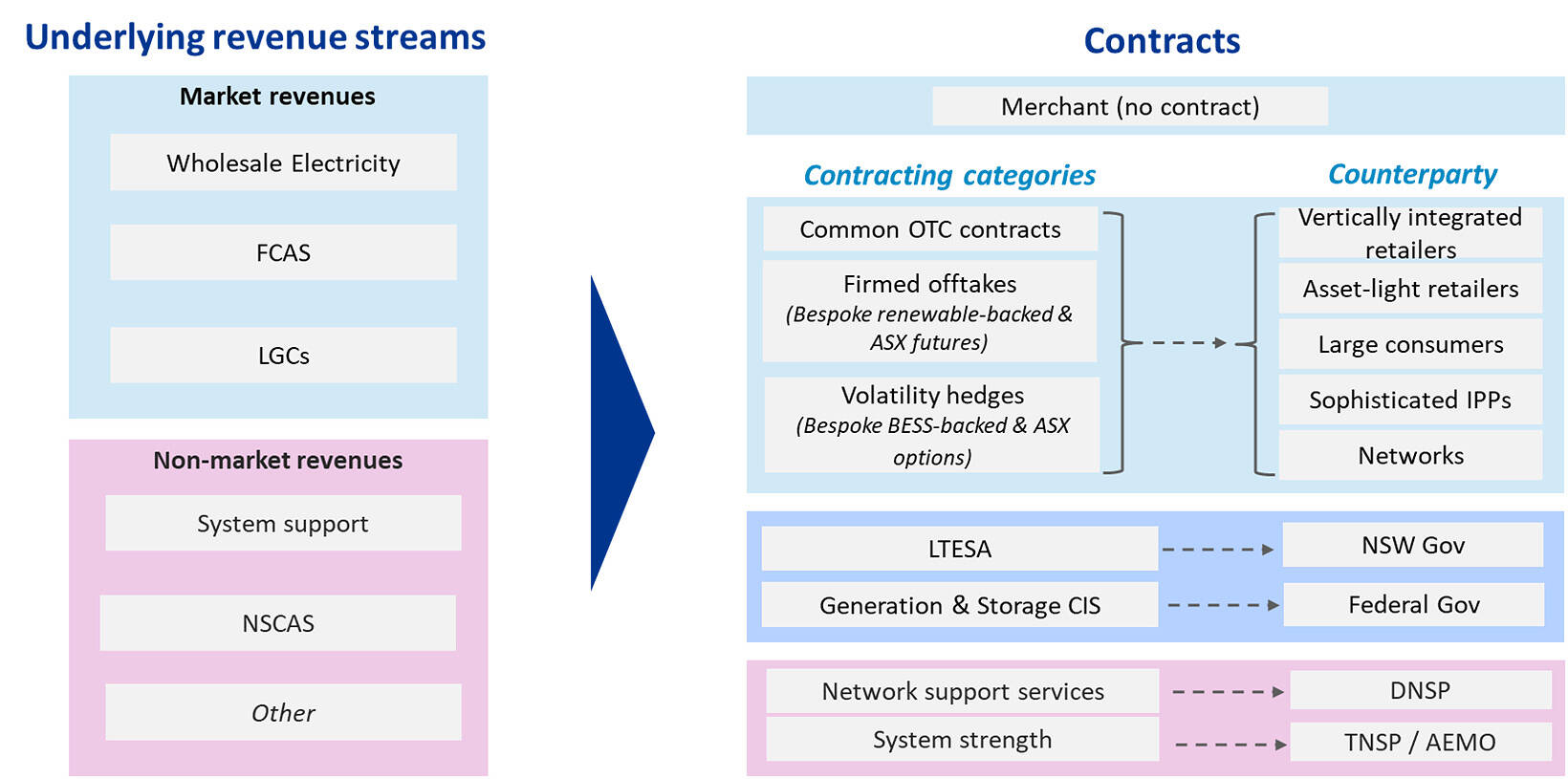

There are a variety of routes to market for energy assets in the NEM, with most projects now stacking revenue streams and contract types to reach commercial outcomes. This is being driven by a range of factors, including government underwriting schemes like the Capacity Investment Scheme (CIS) and NSW Electricity Infrastructure Roadmap — which drives the tendering of Long-Term Energy Service Agreements (LTESAs).

Source: Baringa

While there will always be a range of different buyer and seller objectives driving contracting behaviour in the NEM, the market is tipping in favour of more diversified revenue strategies. The movement away from longer-term contracts with a single buyer is being driven by:

- High balance of plant costs are sustaining elevated PPA offer prices, reducing the attractiveness of long-term contracts to creditworthy offtakers

- This, and a slight softening in the corporate ambition of some large energy buyers, leads to less appetite for long-term offtake (given it does not offer material savings for the additional risk)

- Large swings in PPA pricing over the past few years highlight the value of optionality around delaying (on sell and buy side) of locking in long-term volumes at a particular time

- Increased near-term volatility equally impacts the perception of risk around market revenues

- A larger proportion of the developer market build or outsource trading capability, driven by batteries or larger portfolios and risk appetite, facilitating risk management around shorter-term positions.

- And then, of course, CIS allows a wider pool of developers to sell shorter-term contracts, given partial underwriting (more detail provided below).

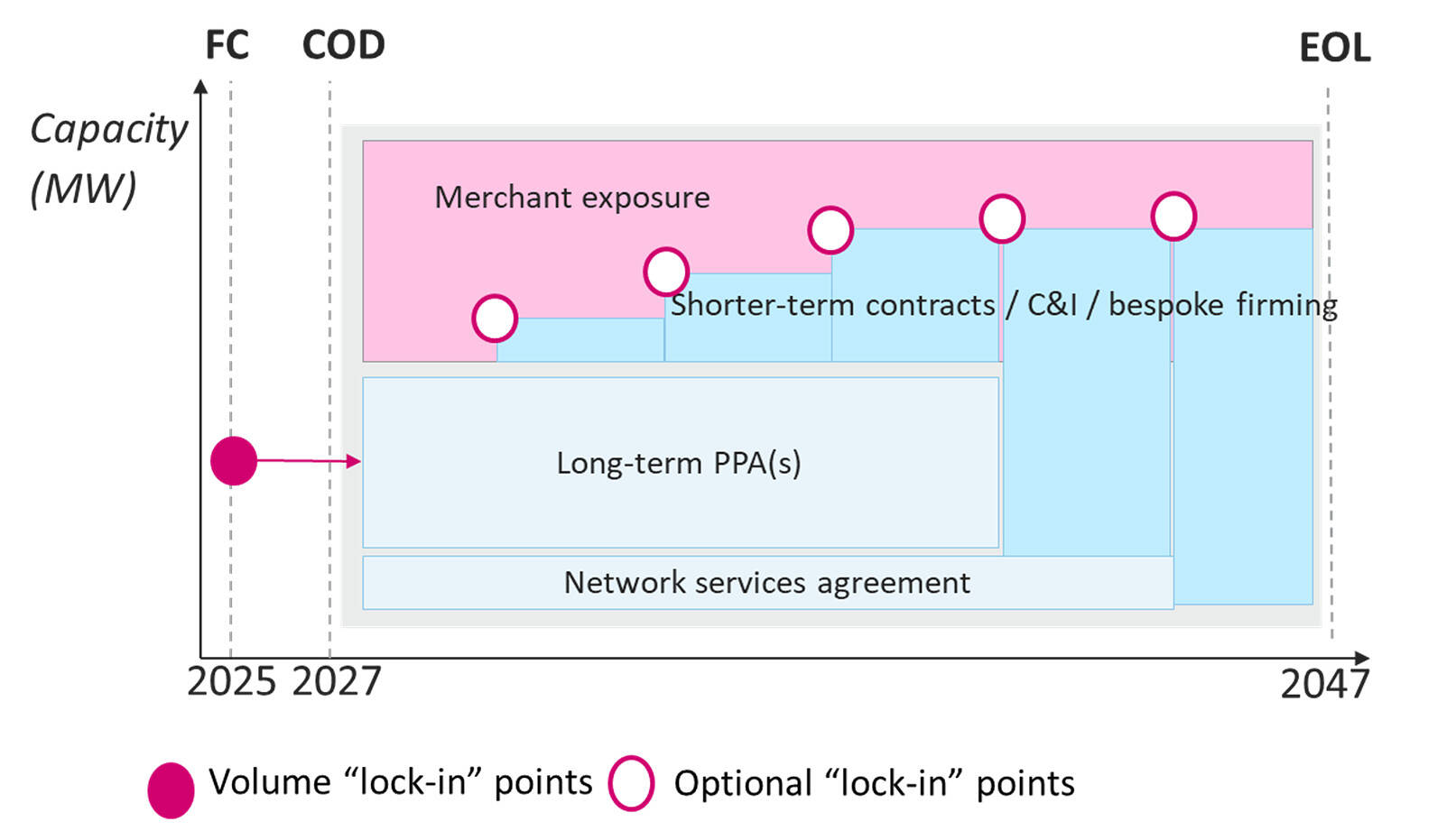

The diagram below illustrates how revenues can be stacked concurrently, or sequentially, to achieve target returns for a hybrid renewable and storage asset.

Source: Baringa

The CIS (and LTESA) plays an important role in revenue stacking strategies

This CIS is impacting the market for PPAs. PPAs are functioning alongside the CIS, with the longer-term de-risking enabling offtake providers to sell shorter tenure contracts.

A growing number of projects will receive government underwriting under the CIS (with a target of 23 GW of renewable energy capacity and 36 GWh of storage capacity by 2030). Alongside this, commercial PPA demand could be 10-20 GW based on gentailer and DC demand. Contracted revenue provides CIS tenderers more flexibility to adjust the size and shape of its Annual Payment Cap bid (effectively the maximum liability to the Commonwealth), improving bid competitiveness. We note that these themes are applicable to the LTESA contract as well, albeit the bid variables are named and structured differently.

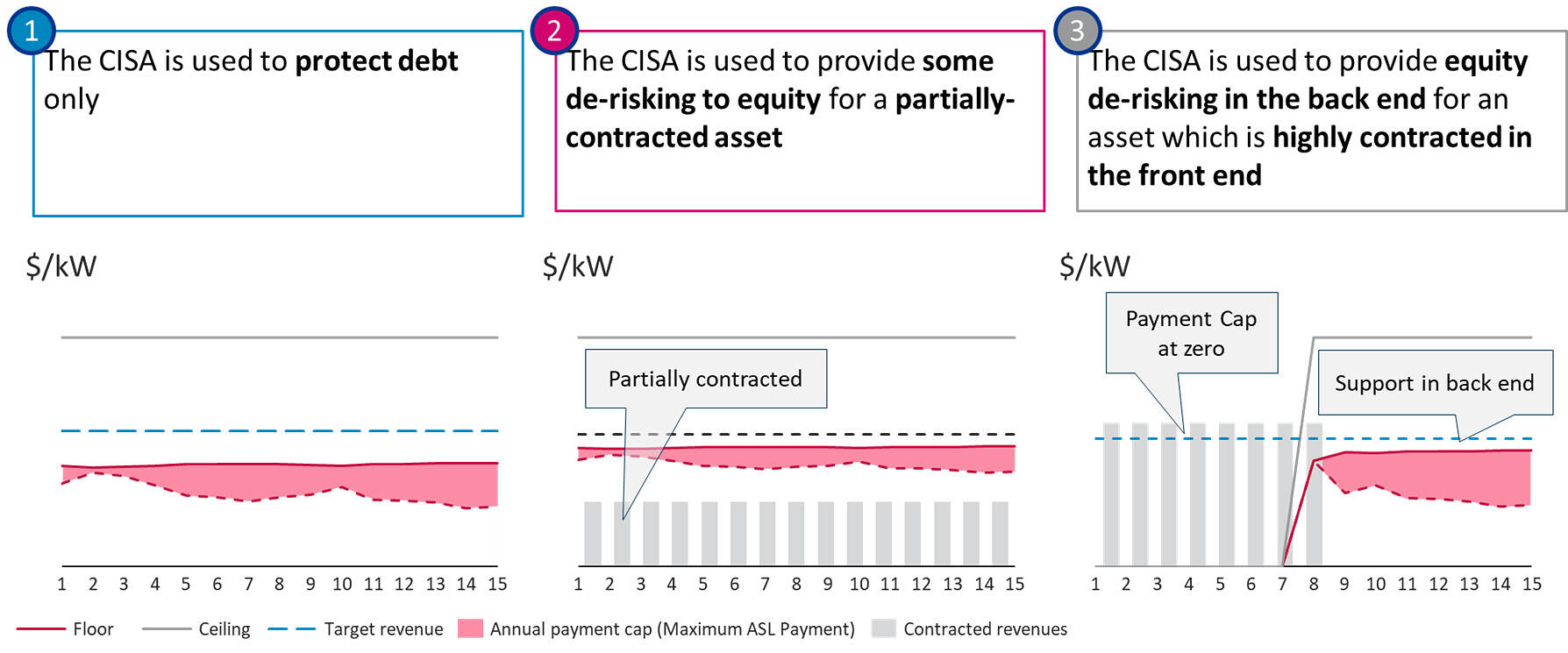

Securing CISAs can significantly increase revenue certainty for a portfolio and improve a developer’s ability to successfully deploy capital, if bid correctly. We see a range of credible bid strategies shaped by contractual positions; a few examples illustrated below.

Source: Baringa

This commercial transition requires a businesses operating model with new differentiating capabilities

More sophisticated commercial models require investment in capabilities to enable greater commercial flexibility. Two capabilities of particular interest to me are a) risk governance and investment steering (i.e. how to quantify the market risk associated with short term positions and overall portfolio risk in a way which can be considered at the point of a new investment), and b) commercial strategy at the project and/or portfolio level, particularly incorporation of government underwriting contracts (e.g. CIS). The figure below summarises the operational foundations (data access/ quality, tooling and analytics, and hedge decision support) and commercial challenges (risk governance, steering, and strategy) of active wholesale market participation.

About our Guest Author

|

Ben Nethersole is a leader within Baringa Australia’s Strategy & Commercial Advisory practice, assisting energy sector clients allocate capital and manage risk. Ben is leading Baringa’s auction advisory offering in Australia. Baringa Partners is a global consulting business providing specialised advice to the energy and resources, financial services, and government sectors. You can find Ben on LinkedIn here. |

Leave a comment