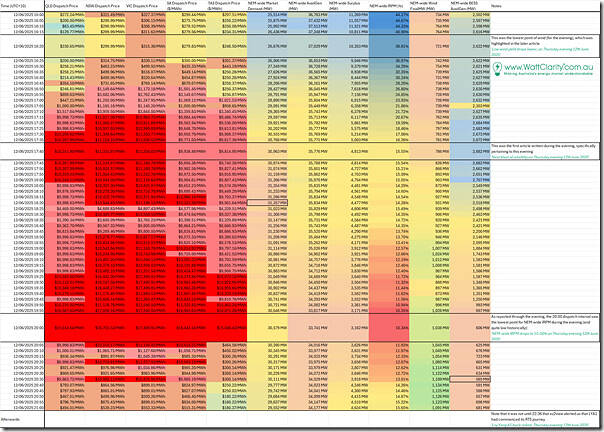

Yesterday I posted this ‘Brief summary of outcomes (Price, Demand and IRPM) for Wednesday evening 11th June 2025’ with respect to Wednesday evening 11th June 2025, and that proved a useful reference point.

So I’ve done a similar thing here with respect to Thursday evening 12th June 2025:

In this case:

1) Note the longer time-range included (i.e. 16:00 to 21:00 … or 5 hours rather than 4 for Wednesday) to cover the longer run of price action.

2) Similar to what I did for Wednesday, I’ve linked to three of the other articles posted with respect to Thursday:

(a) I’ve highlighted the 16:20 dispatch interval ‘Low wind yield drops lower, on Thursday evening 12th June 2025’:

i. noting that this was before the prices really started to run

ii. so we can be grateful the wind started to recover somewhat from that time forwards

(b) I’ve highlighted the 17:40 time for the NEMwatch snapshot captured for this article.

(c) I’ve highlighted the 20:00 dispatch interval, in which ‘NEM-wide IRPM drops to 10.34% on Thursday evening 12th June 2025’

… noting that this was a low point for BESS availability, as speculated yesterday evening

(d) I’ve highlighted ‘Loy Yang A1 back online, Thursday evening 12th June 2025’.

3) Note also the two columns added at the end,

(a) Aggregate NEM-wide wind output … measured as ‘FinalMW’;

(b) Aggregate NEM-wide BESS availability … i.e. bid to discharge ENERGY, at any price.

Does anyone have thoughts on why the bidding for VIC was so often 9c short of the market cap?