Yesterday we posted ‘A first quick look at bids for NSW participants, including Wednesday 8th May 2024’ – including (amongst other things) an aggregate level view of coal generator bidding in NSW, looking back 30 days.

In this article we’re going to narrow the date range (i.e. back 4 days from 04:00 this morning, Friday 10th May 2024) – so both:

1) extending more than 24 hours into the ‘NSW under Administered Pricing’ regime,

2) but also spanning the volatile periods of Tue 7th May evening, Wed 8th May morning, and Wed 8th May evening.

We’re still using the ‘Bids & Offers’ widget in ez2view.

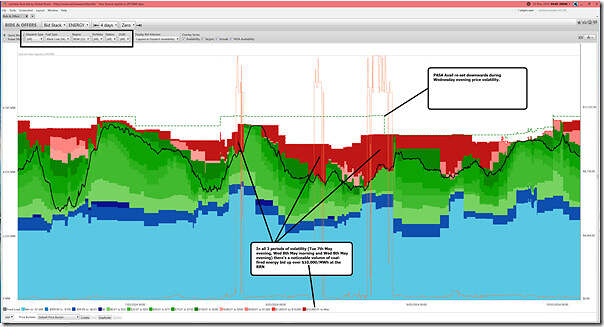

(A) All coal units across NSW (4 stations)

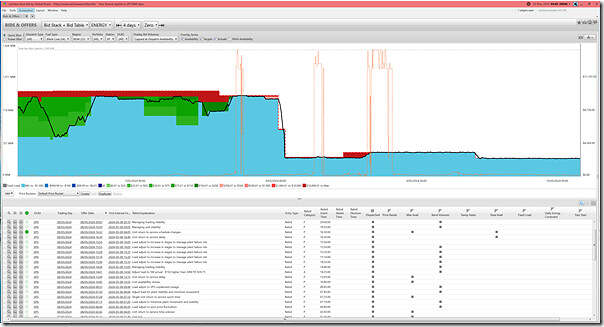

There are 4 coal-fired stations remaining in NSW at this point – here’s the shorter time-range aggregate view:

As highlighted here, there was a significant volume of energy bid up above $10,000/MWh through periods of volatility … and (to my eye) the percentage volume is higher in Wednesday evening than in Tuesday evening.

(B) Unbundling, for each of the 4 x NSW coal stations

Let’s unbundle for each of the coal stations, alphabetically…

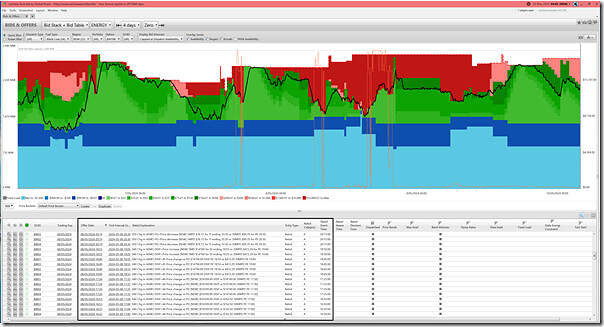

B1) Bayswater

Remember that this station had all 4 units running through the period:

Underneath, I’ve shown the ‘Bid Table’, and tried to scroll to show rebids relevant to Wednesday evening … though there are too many to show in this image. Note the rebid reasons referencing commercial considerations (note to readers – ‘making money’ is not against the rules).

B2) Eraring

Remember that this station had all 2 units offline for unplanned outages during this period (ER03 returned last night, whilst ER02 is still offline as I type this):

In this case, of the two units that were operational, all bids were below $300/MWh during the volatile periods (partially higher outside of them).

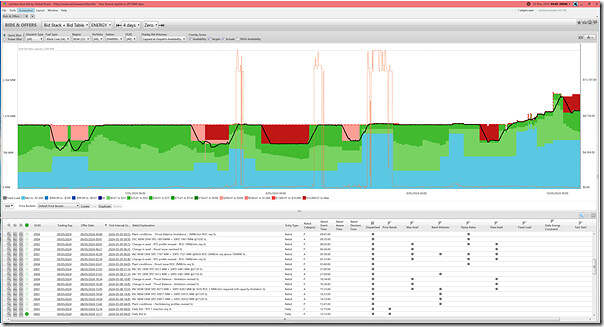

B3) Mt Piper

This station had both units operational:

This station had (more noticeably than for Bayswater) reduced aggregate capacity available on several occasions outside the volatile periods – but during the volatile periods all capacity was available, though some of it was priced > $10,000/MWh.

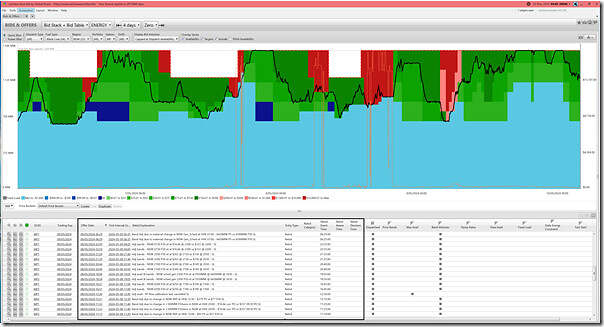

B4) Vales Point

Remember that this station had lost the VP5 unit in the early hours of Wednesday morning 8th May 2024:

The outage of the unit is clearly seen here, as is the low load capability of the sibling VP6 unit.

There are obviously more questions that arise from the above (perhaps different questions for different readers), but we’ll leave it there for now…

Looks like Bayswater and Mount Piper trying to punish Origin – ouch!