This article was originally posted on LinkedIn, where there are other comments.

ABC’s 7:30 Report had a piece this week on the plan by AEMO to curtail small rooftop solar installations under certain conditions.

What followed can only be described as white-hot rage from residential solar owners.

From a technical perspective centralised control is necessary and inevitable. The average Aussie doesn’t think the grid’s stability is their responsibility, so I want to point out that it is in the financial interests of solar owners too.

Solar Equity

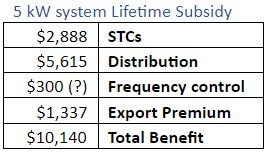

First a recap on residential solar incentives. Residential solar is the most expensive kind of solar on a cost of energy basis. It’s economic viability stems from a few different explicit and implicit subsidies.

- An upfront capital subsidy (STCs) that could nearly pay off an entire utility solar farm if large scale got the same thing.

- A saving on distribution payments. Residential solar doesn’t reduce the Regulated Asset Base so a solar owner’s savings are paid for by others.

- Avoidance of large generator responsibilities, e.g. paying for frequency control services and providing voltage control. It also increases the need for these things.

- Export tariffs higher than wholesale value.

These gains are paid for by non-solar customers, especially renters.

Note that I don’t lump in commercial solar; it is cheaper, receives fewer direct subsidies, and is exposed to cost reflective tariffs. Its economic viability is real.

Utility solar is the cheapest, bears the most responsibilities, receives negligible direct subsidies, and produces more during peak times.

The Value of Responsiveness

Let’s get to the carrot.

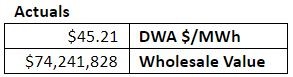

For the past year SA rooftop solar’s wholesale weighted value was 4.5c/kWh. Production was about 1.6 TWh.

If rooftop solar had switched off during negative prices its dispatch weighted average price rises to 7c/kWh, but production falls to 1.4 TWh.

Overall, the controlled rooftop solar generation was worth 33% more over the year, despite generating 13% less.

Quite simply if solar owners reduced their production they would earn more. It’s a straightforward incentive to get proactive about control. For a 5 kW system it’s worth roughly $100 per year.

The Need for Better Control

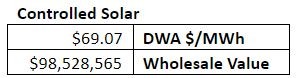

This simplified control mechanism hides a big threat though.

The actual largest half hourly drop in SA rooftop generation was 423 MW. By introducing widespread binary control, the largest deviation is increased to 926 MW. 400 MW is already enormous for such a small region, 900 MW is almost certainly going to lead to disaster.

Many solar inverters are configured for distributed control, but this is only on-off control. We need proportional, relative control.

If AEMO gets their way with DPV curtailment they have a difficult choice of how to use it. If an insecure operating condition is forecast AEMO can’t just switch off DPV when the issue is active – that would cause even bigger problems with a big swing in generation. Without proportional control they will have to initiate curtailment before DPV production ramps up. This means when challenging conditions are forecast DPV will be curtailed all day.

Let’s be honest – we are nowhere near having coordinated centralised control of DPV. A two sided market like the ESB wants is years away. What can we do in the meantime?

The pricing piece is the easiest. Retailers already offer pool price exposure on consumption and exports. A solar owner can be paid the wholesale price which overall is more lucrative if they dodge negative price.

If the dodging behaviour is standardised and graduated it can be helpful and not dangerous.

For example, reducing output over time in reaction to price. Rooftop could reduce maximum output by 10% when price goes below $10/MWh and reduce by another 10% each interval the low price is sustained. As price recovers production is only increased by 10% per 5 minutes.

This gives AEMO a predictable behaviour they can input to demand forecasting.

In the above example an on-off response produces highly dangerous swings in output of over 700 MW, only limited by potential production. The graduated control produces a predictable ramp up of 94 MW per 5 minutes.

The benefit to the solar owner is slightly reduced because they produce a little less than the binary response, and because they are exposed to some negative prices.

What Next?

To pull this kind of control off we need inverters that can respond to setpoints, and controllers to provide setpoints.

Some inverters already have inputs that could be used for this e.g. Modbus. I’m not sure how widespread the controllability of installed inverters is. Any guesses?

A controller would be pretty easy to set up. It needs to speak to the inverter and check spot price data. Ideally it would also be able to send data to AEMO on intentions, potential power, and actual power.

I have no doubt the many qualified Australian technology suppliers in the industry could put something together quickly.

If you are in the residential solar industry get proactive on this, it’s good for your customers and you’ll have to live with control like large scale generation. The more people that commit to control the less the pain is on new installations.

If you are a state regulator, make cost reflective tariffs mandatory. The current tariffs are inequitable and driving bad behaviour and inefficient investment.

DWA = Dispatch Weighted Average, same as Generator Weighted Average, Dispatch Weighted Price, Volume Weighted Average. We have too many names for revenue/MWh!

——————————————-

About our Guest Author

|

Tom Geiser is a Senior Market Manager at Neoen and is currently based in Sydney.

You can find Tom on LinkedIn here. |

Over-egged.

I don’t think you need linear control of individual solar systems to get a linear response. A couple of hundred thousand individual systems with different setpoints looks pretty linear at a macro scale.

There is probably enough solar in SA to alter the market price for energy significantly. I’d expect the negative price periods would reduce if you switched off all the rooftop solar.