New South Wales recently experienced a severe heatwave, which saw parts of the state exceed 45°C. These extreme conditions put significant strain on the electricity market from the 9th to the 11th of February 2017.

During this three day period, small solar PV (i.e. PV systems that are not registered as generators in the NEM), generated about 17 GWh of power. This was 2% of the state’s total power needs. If we match up small solar generation with the wholesale price in the NSW market, we can see that small solar was worth about $9.6 million, or $550/MWh. However, a small solar owner is lucky to receive 8 c/kWh or $80/MWh as a feed-in tariff.

The story of the value of small solar during the heatwave doesn’t stop there. The interesting question to me was how would the electricity market cope if there was no small solar. This is difficult to quantify, but my attempt considered three factors:

- What would electricity demand in NSW look like if the generation from small solar had to be met by the market. Data published by the Australian PV Institute was used for this analysis.

- Given this new demand profile, what would the 30 min electricity price be in the wholesale market. To develop the likely set of prices without small solar, the 5 min bid stacks published by AEMO were examined for each period where small solar was generating power.

- What would be the cost to the market with small solar (i.e. the actual cost that was incurred) vs the cost without small solar (i.e. the estimate derived from 1 & 2).

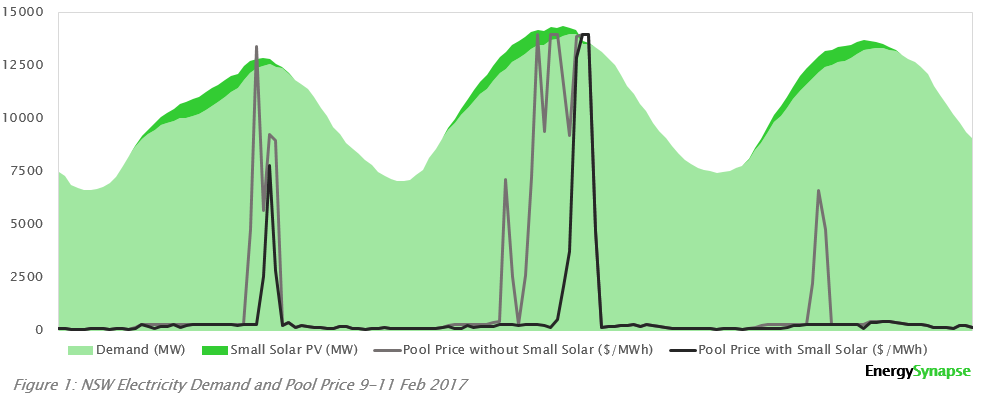

Figure 1 shows the data for the 9-11 Feb 2017 study period. The light green shading shows the actual electricity demand that was seen by the market. The dark green shading shows the estimated generation from small solar PV. The effect of small solar was to reduce the length of peak demand and to push the peak to later in the afternoon.

The black line is the actual 30 min pool price that was seen in the NSW wholesale market. The grey line is the pricing that would have resulted if the power generated by small solar had to be met by the market, assuming that bidding behaviour remained the same. Under these conditions, the effect of small solar was to significantly depress pricing in the wholesale market. Furthermore, it is likely that AEMO would have called for involuntary load shedding during the afternoon of Friday 10 Feb, as there were periods with not enough generation bids to meet the extra demand that small solar was covering.

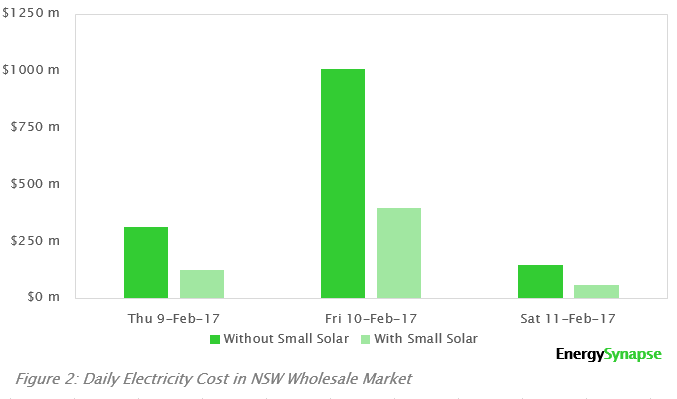

The final consideration is the total cost impact to the market with and without small solar. In part 2, we derived the likely pricing without small solar. However, it is not just the solar portion of demand that would be subject to this new pricing. The way that the NEM is settled means that the entire demand in the state for a given 30 min trading interval would be subject to the new 30 min price. Figure 2 shows the daily electricity cost in the NSW wholesale market with small solar (i.e. the actual costs incurred by market participants) and without small solar (derived from our analysis).

Over the three day period, small solar reduced the cost to the market by roughly $888 million. Even though small solar only covered 2% of electricity demand, it cut the price of electricity by 60% from an estimated volume weighted average price of $1920/MWh to $780/MWh.

This article was originally published on LinkedIn.

Note:

In this “what would have happened?” analysis, Energy Synapse have (necessarily) made a number of simplifying assumptions. This is standard procedure in this type of analysis.

The region-specific as-dispatched bid stacks have been used, with an increment in terms of additional Scheduled Demand, to calculate the “what would have been” prices. In doing this:

- Simplification #1 = it has been assumed that bid behaviour would not have changed; and

- Simplification #2 = no account has been taken of how underlying constraint behaviour might have changed the dispatch (hence pricing) outcome with this additional Scheduled Demand in place.

|

Marija is the Founder and Managing Director of Energy Synapse. Marija has worked globally in the energy industry, with her experience covering energy management for the C&I sector, consulting, and research.

In addition to the above article we’ve published on WattClarity, Marija has also recently had this article about record electricity prices in QLD posted on our sister-site DemandResponse.com.au You can view Marija’s LinkedIn profile here. |

Yeah no. The spot price you are referring to isn’t the actual price experienced by the customer. 90% is contracted at a significantly lower rate, more like 5c/kwh rather than the low 8c given to the ‘poor’ home solar people (excluding transmission and retail of course). Perhaps we should estimate the massive waste of taxpayer money incurred when home solar owners were reimbursed 60c/kwh gross (irrespective of whether they used that power or not) when the average price for generated power was 3c/kwh over the 3 or so year period the scheme was in place. Which one do you think actually hurt your wallet more?

Hi Adam,

Thanks for your comment. The analysis in this article relates to the wholesale (spot) electricity market. All retailers pay the spot price to AEMO, and conversely all generators receive the spot price from AEMO. Most market participants also hedge their exposure to spot pricing in order to firm up revenue (for generators) or cost (for retailers). Hedging instruments are settled against the spot price and hence their price is largely determined by the market’s expectation of spot pricing. The current futures pricing for NSW baseload Q1 2017 is about $120/MWh or 12c/kWh.

Residential consumers pay a fixed rate to a retailer. Of course, this fixed rate incorporates the costs to the retailer as explained above.

As for the solar bonus scheme (which has been discontinued), its purpose was to encourage the uptake of solar PV in the early stages of adoption in the Australian market and it has certainly achieved that goal. Yes, 60 c/kWh was a high feed-in tariff, but remember that solar panels are a 20 year asset. We will be reaping the rewards for a long time yet.