SMS alerts triggered from NEM-Watch this morning alerted us to a few price excursions up around the market price cap.

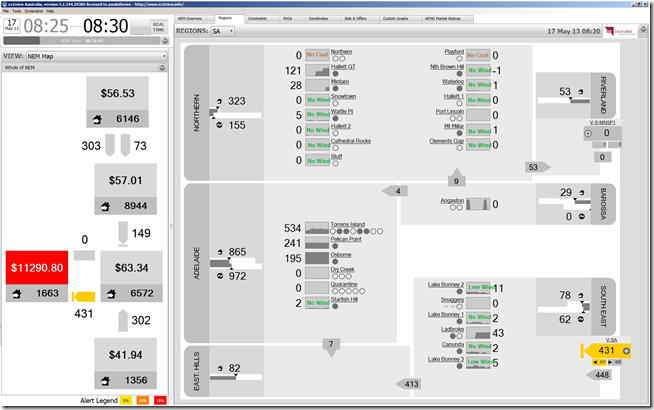

By referencing ez2view we can see some of the contributing factors, as noted in the following snapshot of the market with the price spiked at 08:30. We see that Alinta’s coal plants in the north are not operational (as per their announcements) and that the output of wind farms across the state was negligible, due to low wind.

Because of the shortage in local generation sources, we can see that SA is importing from VIC to the maximum current capability of the Heywood line, whilst Murraylink is not available to supply at present.

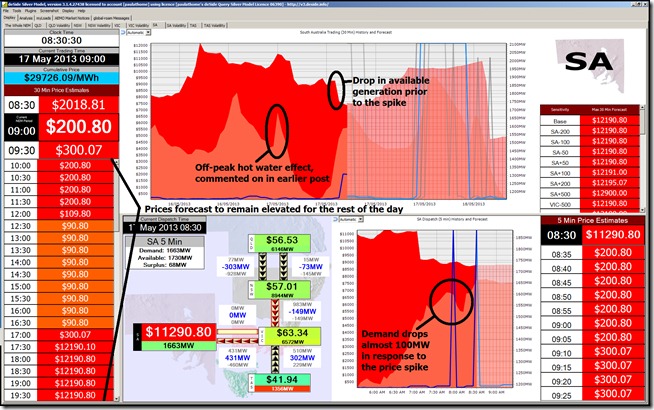

For a bit of a different view, we’d added in a view from deSide (our tool specifically designed for large energy users providing Demand Side Response (DSR) in the energy market). In this image we can clearly see the effect of the DSR that had been triggered a short time earlier by the first price spike:

A third price spike at 09:05 as this post goes live.

Will be an interesting day for those in, or focused on, SA…

.

We’re not just taking a deeper look at the volatility in QLD over summer 2013!

We have been investing a considerable amount of time in preparing this review, which will be released at the end of May. This has not stopped us keeping an eye on current market activity, such as highlighted in this post.

What happened in QLD over summer is not just important to those in QLD, and those directly affected by summer – as it highlights a number of significant changes that have occurred in the market recently. These changes could have implications for other regions, and other times.

To pre-order your copy of this report (and save 16%), please fax back this order form today.

Leave a comment