This weekend, we have prepared this analysis of the entries we received for our “Peak Demand Forecaster” competition for winter 2009.

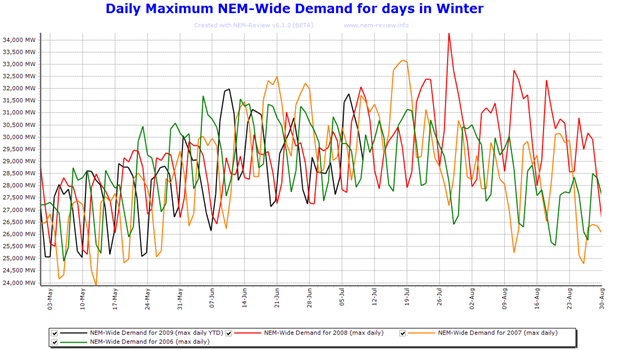

In conjunction with this analysis, we thought it would be of interest to also incorporate this chart (generated from a BETA version of the NEM-Review v6 software package) to highlight how the peak NEM-Wide demand unfolded over the previous winters:

From this chart, the following can be seen:

Winter 2006

Peak demand in winter 2006 occurred early that year – indeed, in the first week of June – where the demand** reached a level of 31,705MW.

As can be seen from the green line on the chart above, demand progressively reduced throughout the winter period of that year – which we presume (but have not verified) was due to milder weather being experienced for the rest of the season.

Winter 2007

Peak demand in winter 2007 occurred in mid-July. As can be seen in this chart, the peak demand grew by more than 1,400MW on the peak recorded in the previous winter to reach the level of 33,171MW on 18th July 2007.

On a related note, in June 2007 (i.e. prior to this new peak being set) we previously reported the remarkable instance when the NEM-Wide Instantaneous Reserve Plant Margin plunged to its lowest-ever level on the back of an early cold snap in the market, causing demand levels to jump. As shown in this snapshot from NEM-Watch, the NEM-Wide demand experienced on those two days was around 32,350MW – so still 900MW below the peak experienced for winter.

Winter 2008

The following year, peak demand grew again- this time by another 1,100MW.

As shown in the chart above, the peak demand reached a level of 34,292MW late in July. We previously reported this in our review of 10 years of NEM history, focused on the month of July.

Winter 2009 (to date)

As seen in the chart above, the peak NEM-Wide demand experienced thus far this winter has been at the relatively moderate level of 31,971MW (experienced early in June 2009 – or prior to us even launching our latest competition).

As can be seen, this demand peak is about 2,300MW below the peak experienced the previous winter, so we would expect that the demand level will climb considerably further this winter (as did most of our entrants).

** Note that these levels of demand are obtained from NEM-Review, which provides access to historical Trading (i.e. 30-minute) data. Hence these measures are of the Trading Demand Target experienced in each winter, and (as such) would be slightly lower than the peak Dispatch (i.e. 5-minute) Demand Target experienced for each of these winter periods.

Be the first to comment on "A brief look at peak NEM-Wide Demand over recent winters"