The following article is based on a presentation from Overwatch Energy’s Operations Manager, Ellise Janetzki, at All Energy in Melbourne last week.

At Overwatch Energy we often get asked what a control room actually does. Is it just bidding and trading? Doesn’t the auto bidding system (ABS) just do that? Isn’t an ABS smarter than a human, so why not just leave it alone? What else does a control room do? In reality there are two key functions, or two worlds that a control room operates in that are often mixed up or, worse forgotten.

This article will focus on what a NEM Operations control room really does and give a sense of the requirements in the NEM; the same applies to the WEM. Think of your control room as an insurance policy, that one day, you’ll be very glad you had experienced operators in place 24 x 7.

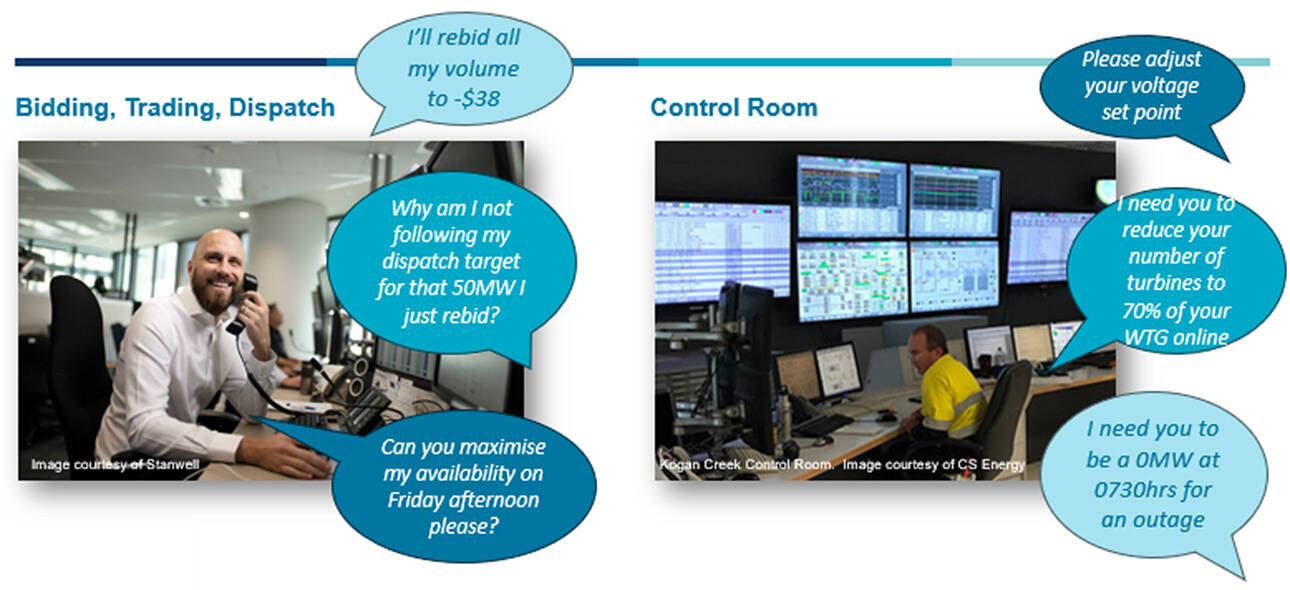

The two worlds – the financial & power system security

The first world that a control room operates in is the financial world – the dollars and cents, making money. This is your bidding, trading and dispatch. Watching, checking the market prices, bid stacks, bid positions, constraints and market conditions to ensure you’re making money. Or for some perhaps minimising losses.

The second is the world of power system security. We all take for granted that our lights, our heaters, our electricity just work. But that only happens if the market participants are all working with AEMO to ensure the power system remains secure. This includes making sure supply matches demand – with reserves in place for low supply and low demand, as well as your voltage control, frequency control and your system strength.

Below are some features of these two different worlds:

- On the left is the financial speak, the traditional trading room. Talking about bids & offers, what is available to sell or buy at different times.

- On the right is power system speak, adjusting voltage set points, managing inverters or turbines online for system strength, and what is probably the most routine work for our control room, managing outages.

You need to ensure you have the right people with the right skill sets to manage both.

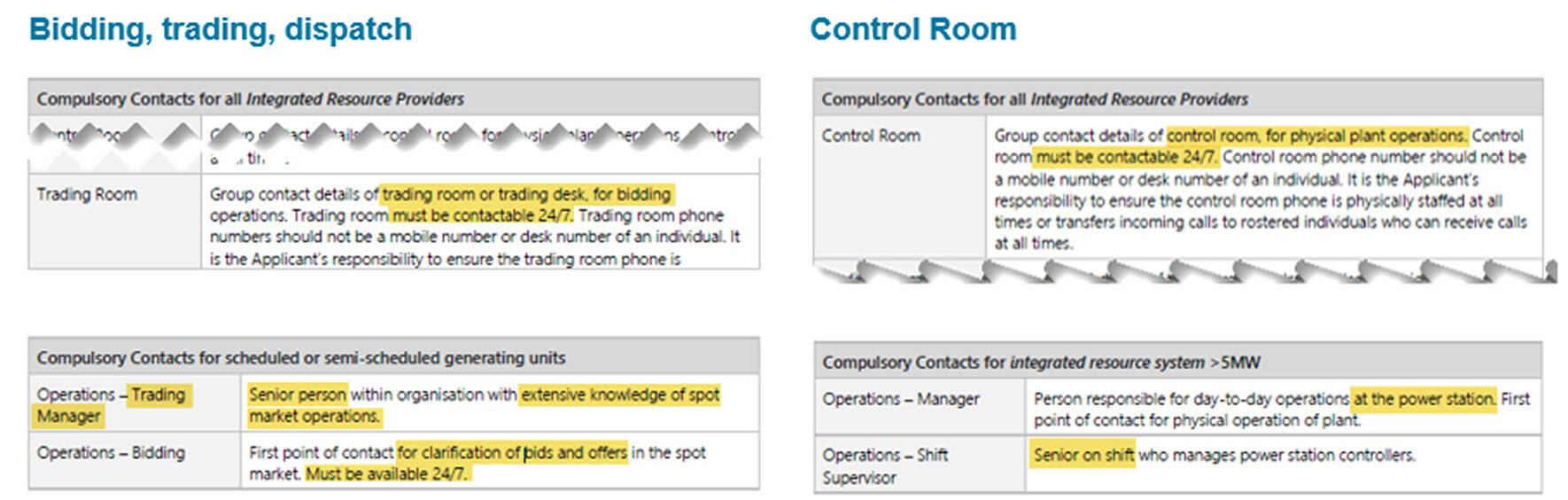

AEMO and the AER need you to cover both

So how do the Market Operator and the Regulator AEMO see this?

The following is from the AEMO Registration Guidelines. You can see the demarcation between:

- The trading room or desk. Requiring senior people, with extensive knowledge of spot market operations, contactable 24×7, and

- The control room for physical plant operations, with senior power station controllers on shift, contactable 24×7.

AEMO is quite clear about the need for experienced humans to oversee plant and market operations.

What, no software?

AEMO ask nothing about any bidding software, ABS, or “optimisers.” They require humans to answer the phone. They assess and expect competent humans who can act immediately.

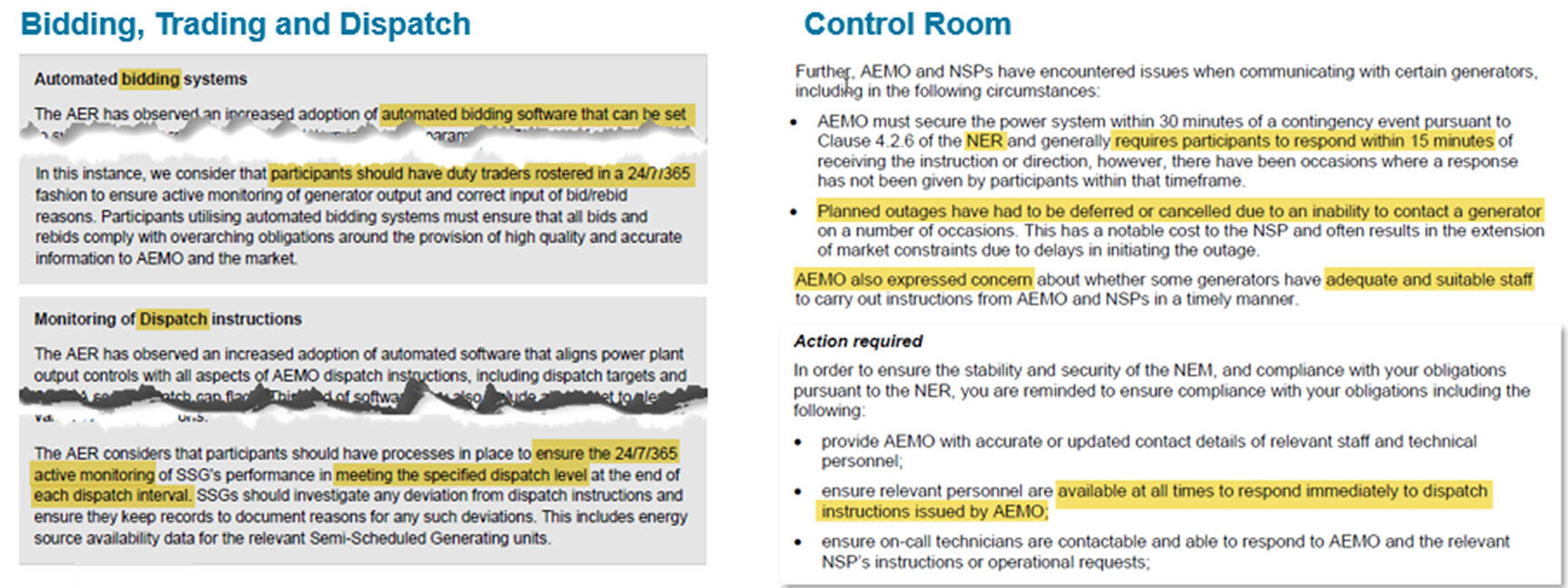

The AER, in recent compliance bulletins, responding to failures by participants, make this requirement quite clear. Emphasising that participants must have human oversight of automated bidding software, and processes in place to monitor dispatch levels 24/7.

Note that the law requires (NER 4.2.6) AEMO to re-secure the power system within 30 minutes of a credible contingency. The AER makes it clear that by the time a (human) AEMO controller has assessed the situation and taken necessary action, participants have at most, 15 minutes to respond to an instruction or direction from that AEMO controller.

At Overwatch, we regularly receive instructions and communications with the AEMO control room that have required immediate action; these include emergency outages or shutdowns, communications failures or limiting turbines or inverters for maintain system strength.

On the left are extracts from AER’s February 2025 Compliance Bulletin. On the right extracts from an AER letter to a participant.

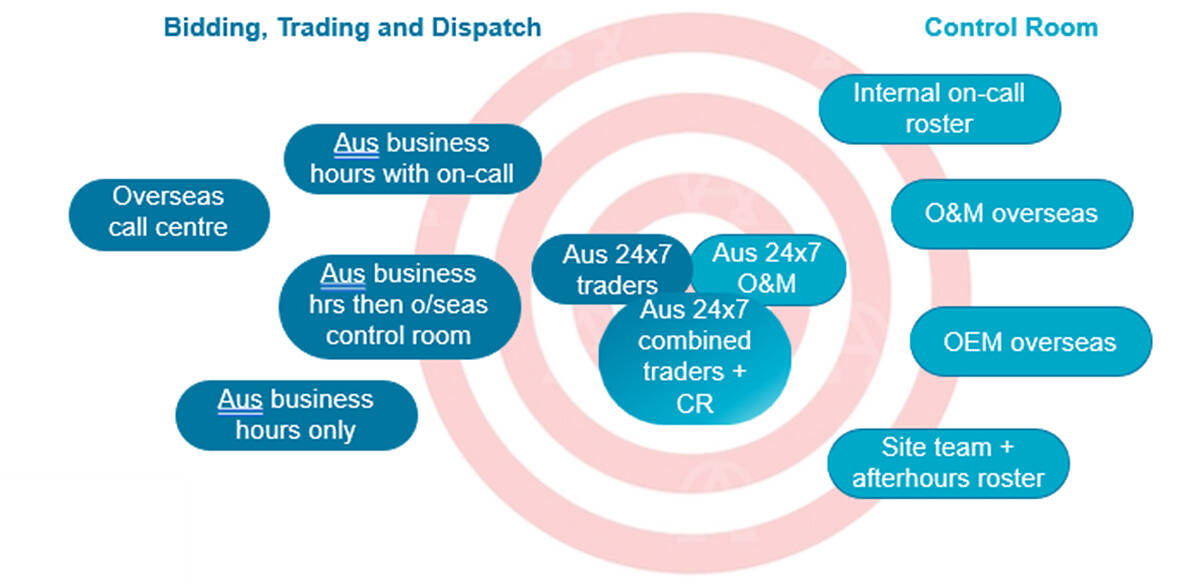

How are the requirements for a control room commonly met?

We’ve put some examples of arrangements we’ve seen across the market and suggested how close to meeting the “bull’s-eye” of the AEMO and AER requirements they get; see below. They include:

- Overseas control rooms

- ‘Follow the sun’ arrangements, split between Australian business hours and overseas

- On-call trading rosters

- Site teams providing on-call rosters

The different types of arrangements we’ve seen across the market — in relation to the ‘bulls-eye’ what’s required by AEMO and AER.

Use of overseas control rooms

Putting cyber security aside, I agree that it might not matter whether someone is located in Australia or not; so long as they are competent operators trained and experienced in the NEM, appropriately supervised, monitoring output and able to receive and promptly respond to calls, alarms and issues. However we do observe that overseas rooms typically try and cover assets in multiple markets, so the NEM is not their sole focus. A trading or control room that does not know the NEM well enough is a problem. They won’t have the knowledge or experience in the NEM to be able speak “NEM” with AEMO or the NSPs in the way they need, and that’s a problem for power system security – and maybe also the financial performance of the asset.

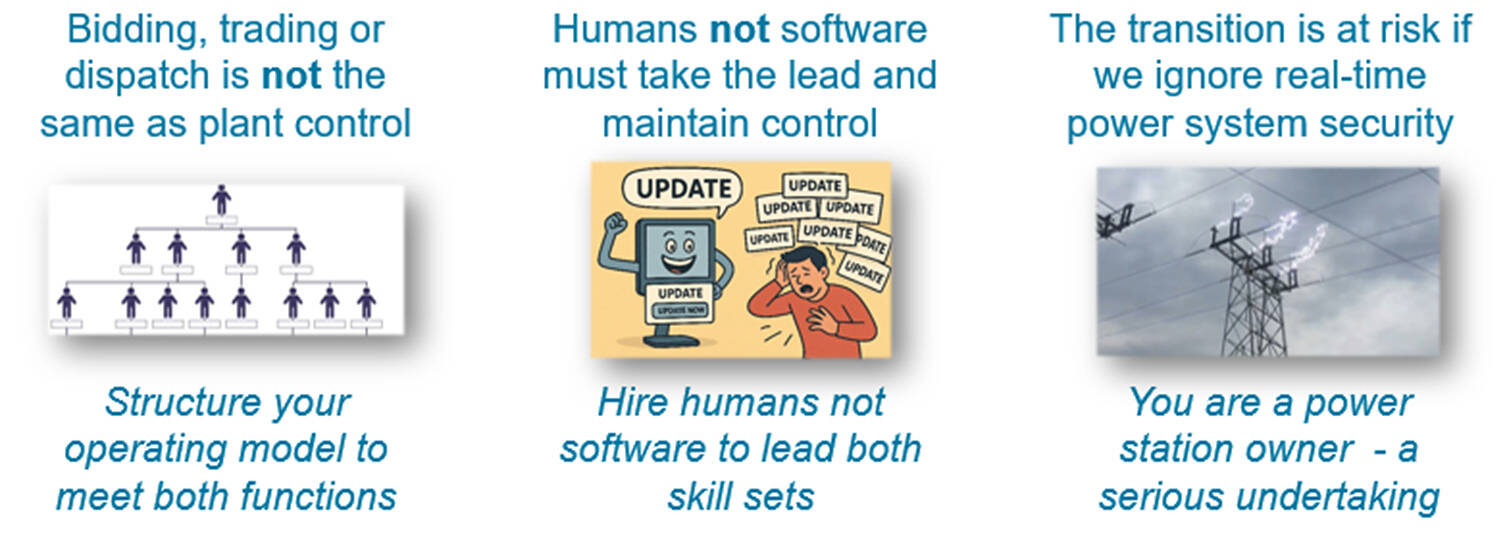

Three takeaways for setting up your control room

- Bidding, trading and dispatch is not the same as plant control. All power stations must ensure their operating model covers both functions adequately, with the right skill sets.

- Humans, not software, must remain in control. Do not try and suggest your auto-bidder will answer the phone for you; it will end badly. See here for more recent commentary on auto-bidders.

- The energy transition is at risk if we don’t pay due attention to real-time power system security. Power station owners must ensure they have the expertise available to work with AEMO and the NSPs keep the lights on.

Remember – your control room is your insurance policy, you may one day be very glad you had the right people in place.

|

Ellise Janetzki is Operations Manager for the specialist NEM Operations firm Overwatch Energy. She leads a team of round-the-clock power sector operators working across more than 20 DUIDs and 2GW of solar, storage and wind in all regions of the NEM.

Ellise has more than 9 years’ experience in energy markets with Overwatch and AEMO, starting in retail and wholesale market then progressing to short-term NEM forecasting, including short-term demand, wind and solar forecasts. Her knowledge of NEM Operations across AEMO and more than a dozen owners offers a uniquely qualified perspective on what makes for successful power station operations. You can find Ellise on LinkedIn here. |

Be the first to comment on "Dispatch, trading and bidding: Is that what a control room does?"