We had earlier posted that today ‘… could be a big day for ‘Market Demand’ in South Australia’, with ‘Market Demand’ potentially as high as 3,200MW as noted in that article.

Update as at the 18:35 dispatch interval

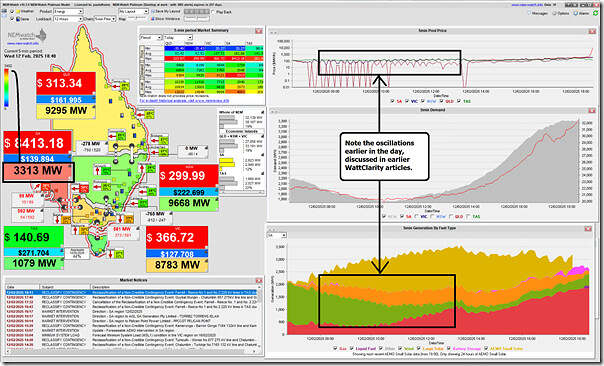

Well, here’s a snapshot from NEMwatch at the 18:35 dispatch interval (NEM time) showing ‘Market Demand’ up at 3,313MW:

Notes:

1) With respect to this particular dispatch interval:

(a) The demand is well up in the ‘red zone’ relative to historical range

(b) Specifically, with respect to this >17 year history of SA daily peak demand we see that this level:

i. Is highest since Monday 31st January 2011; and

ii. Is the 4th highest since 1st January 2008;

… but note it may still go higher

(c) Also note the price has jumped above $8,000/MWh

(d) Because of the fuel mix in play (including low wind generation), and constrained interconnector flow over VIC-SA*; and

* which, as reinforced in a conversation earlier today, should not be really called ‘Heywood’ for a while because of the added ~150MW capability of PEC Stage 1.

(e) And also note that the IRPM of the SA-only ‘Economic Island

2) Also noted on the image is clear evidence of the oscillations:

(a) In both prices, and also dispatch outcomes

(b) Which were discussed in these articles

(c) And appear to be due, at least in part, by a rogue Murraylink term on the RHS of a particular (new) constraint equation.

Update at the 18:55 dispatch interval

The ‘Market Demand’ has reached 3,327MW.

Updates at the 19:00 and 19:20 dispatch intervals

See the subsequent article ‘Spare capacity in South Australia drops below 100MW on Wednesday evening 12th February 2025’.

Leave a comment