Whilst the heat down south has dissipated, Queenslanders have been sweating through some hot and humid days over the past week – these conditions drove electricity demand in Queensland into out of the “boring” green zone and into the orange zone above 8,000MW this afternoon.

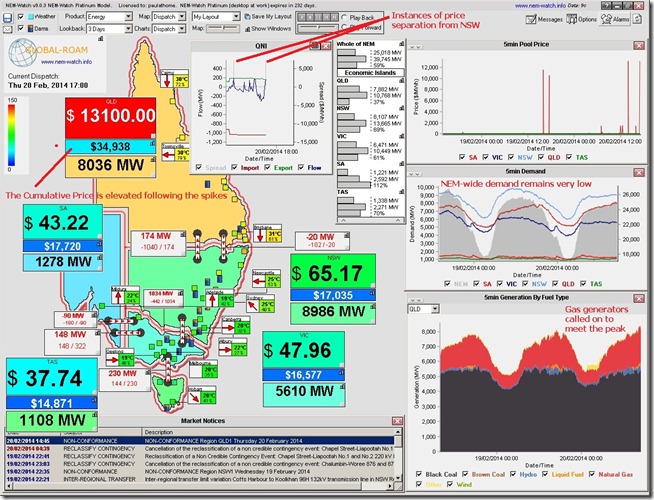

Taking advantage of the higher demand, generators were able to enjoy a couple of price spikes through the day – such as this spike to the Market Price Cap (MPC) of $13,100/MWh (formerly known as VOLL) snapped from the newly released NEM-Watch version 9:

Is the ACT too small to be included ?

Thanks for the question, Keith

What’s shown in the NEM-Watch snapshot above above are boundaries between NEM Regions, as distinct from state boundaries (though in practical terms it’s pretty much the same thing at present).

Hence, it’s more a matter that Canberra is tightly meshed in the NSW region so does not need its own pricing region – moreso than the fact that its electricity demand is relatively small.

For many years at the start of the NEM there was a Snowy Region between NSW and Victoria – as captured in this snapshot on 7th December 2005. Snowy was abolished from 1st July 2008 with part allocated to NSW and part in VIC.

Does this answer your question?

Paul