(NOTE – it’s all been revised!)

Well, this is not something you see every day.

Today being the 1st of July saw the Market Price Cap (MPC – used to be known as VOLL) rise from $10,000/MWh to $12,500/MWh. It only took 12 hours for that level to be reached – as shown below in the series of snapshots taken from NEM-Watch v8.

.

(A) The way it appeared at the time

I’ve put this post up to maintain a record of what we saw in real time, but please keep in mind that the high prices were revised by AEMO shortly afterwards (with the negative prices remaining).

I have endeavoured, in the chronology below, to indicate what changed (after revision) and what stayed the same – please accept my apologies if I have transcribed something incorrectly (if you see anything, feel free to add a comment below).

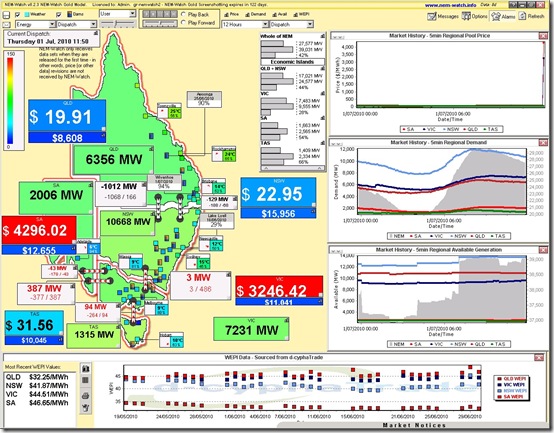

11:50 = market prices spike (since revised)

See below, the first market snapshot automatically taken by our display copy of NEM-Watch v8 today (we have a display copy running with alarms set on a wide range of criteria to do just this):

As can be seen, high prices in VIC and SA are experienced by virtue of (amongst other things) constraints on the interconnectors to NSW, and to TAS (Basslink).

Note dispatched flow into NSW is only 3MW (its minimum possible level at this point in time, by virtue of the constraint limits).

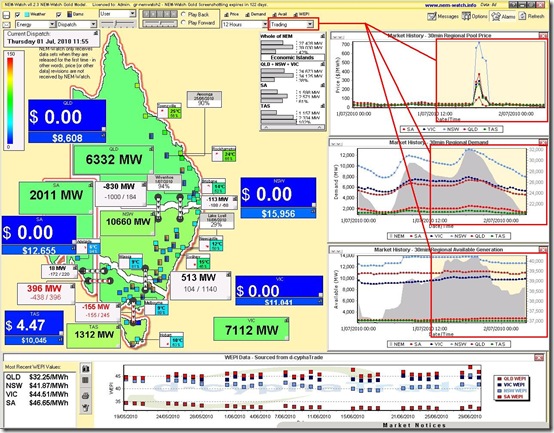

11:55 = prices drop (not revised)

Five minutes later, we see that prices crash to be $0/MWh across the mainland, and almost the same in TAS:

With reference to the situation 5 minutes prior, note two significant changes:

1) Flow north from VIC to NSW has increased by 510MW; and

2) Demand in VIC has decreased by 119MW, possibly due to price-triggered demand-side response.Note in the image above we have switched the view of the 3 charts to show trading data, which incorporates the AEMO’s predispatch price forecast out till 4am tomorrow. See in this forecast a prediction of price spikes this evening, which (if it happens) would be similar to what happened on Tuesday.

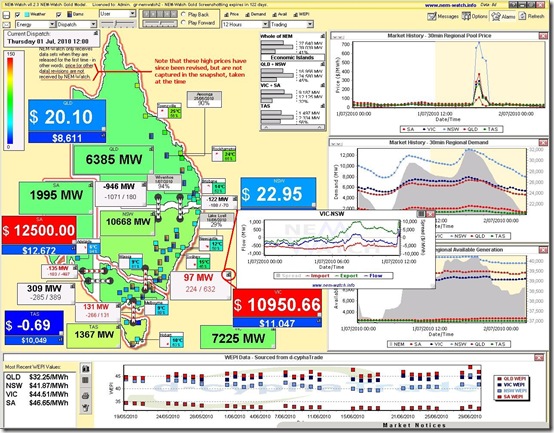

12:00 = jump to MPC (since revised)

Another 5 minutes later, and we see the price in SA has jumped to the new MPC, whilst price is up in VIC as well:

As can be seen in this snapshot, we’ve opened a chart showing the trend in flow on the VIC-NSW interconnector, highlighting how flow has trended in recent dispatch intervals.

Between 11:55 and 12:00 we see the dispatch flow has reduced from 513MW to 97W (a 416MW reduction). Note also that the flow (97MW) was below the export limit shown into NSW (224MW).

12:05 = not available

No snapshot was taken for the 12:05 dispatch interval.

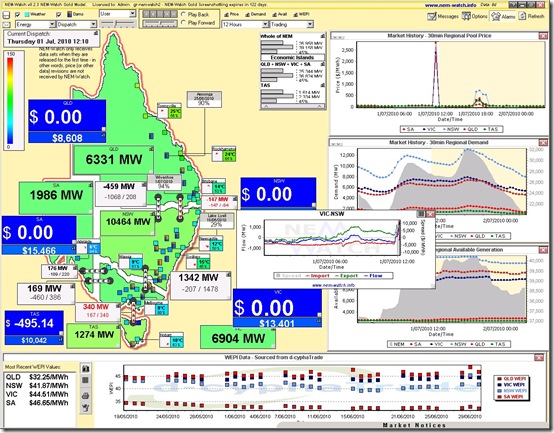

12:10 = down again (not revised)

Another image (below) shows prices had dropped again for the 12:10 dispatch interval:

At this point in time, we see:

1) Flow into NSW had increased to 1342MW – that’s an increase of 1245MW in 10 minutes.

2) Demand in VIC had reduced by 321MW over the same 10 minute interval – a significant amount of load curtailment.

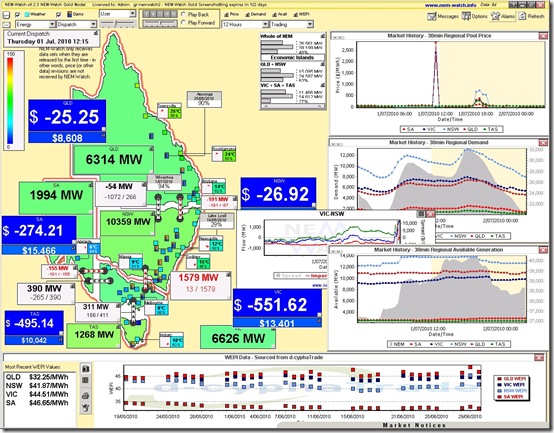

12:15 = negative prices (not revised)

In the following 5-minute interval, we see how prices dropped further across the NEM, into negative territory:

We can see how, over this 5-minute interval:

1) Demand had continued to decline in VIC – by a further 278MW, making it a total drop of 599MW in 10 minutes (suggesting that the Alcoa smelters had reduced demand in response to the high prices).

2) Exports from VIC into NSW had increased by a further 237MW.

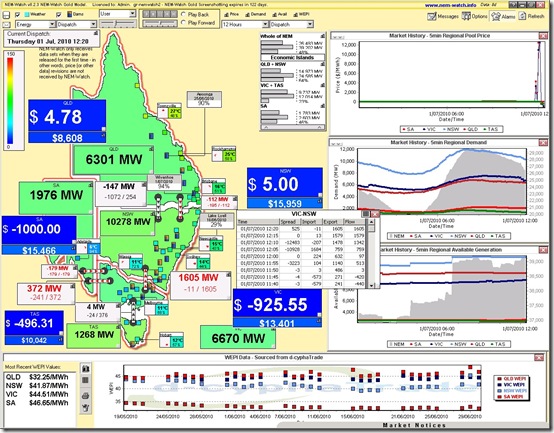

12:20 = prices keep falling (not revised)

A further 5 minutes later, we see prices had bottomed out in SA at the market price floor (-$1000/MWh), representing a change of $13,250/MWh in only 20 minutes:

In this snapshot, recent flows over VIC-NSW interconnector are shown in table format, in order that they can be read more easily.

(B) True History

As noted several times above, the price spikes initially published by AEMO were revised shortly afterwards.

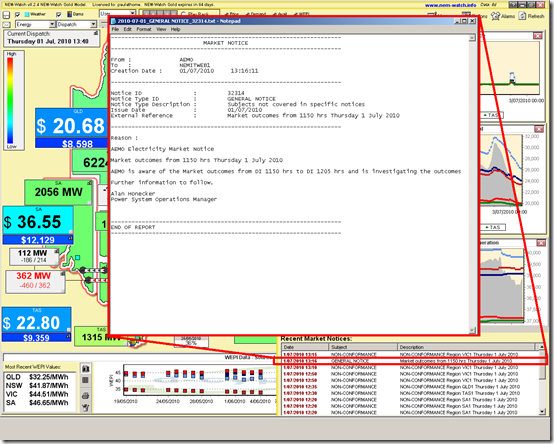

1) AEMO Market Notice

At 13:16, the following Market Notice was published:

We’ll all have to wait a little longer to find out the outcomes of this investigation.

If you hear of these results before we have a chance to add a PS to this article, please feel free to include a link to it as a comment below.

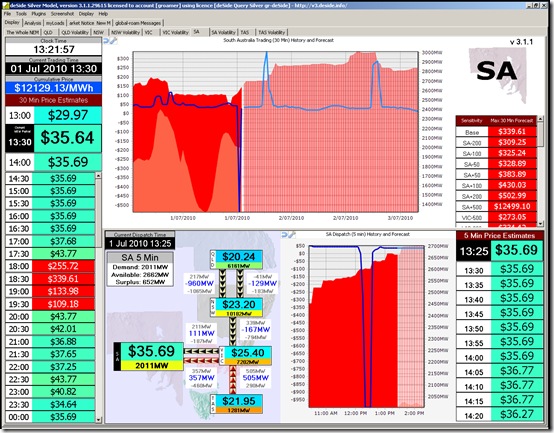

2) Revised History

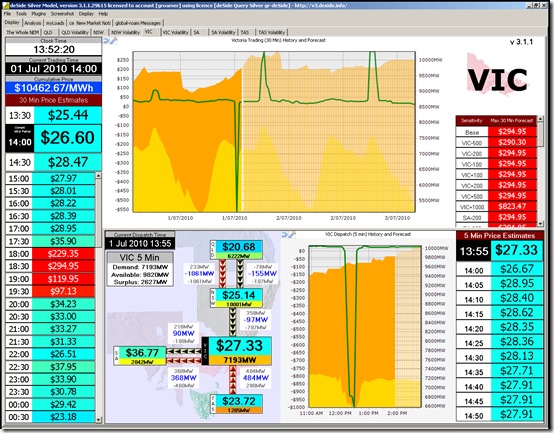

Two snapshots from one of our other software packages (deSide v3 – still in beta for a little longer) highlight how the price history now looks for VIC and SA after the price revisions are taken into account.

The first snapshot shows price data for SA. The chart at the top shows (30-min) Trading Prices, whilst the chart at the bottom shows (5-min) Dispatch Prices.

The second snapshot shows a similar view for VIC:

Note how the price spikes of 11:50 and 12:00 have been revised downwards, but the negative prices remain (at least for now).

3) Implications

We have a number of clients using either NEM-Watch v8 or deSide v2 (or v3).

We’ve received calls from a number of these clients, asking us to clarify what exactly happened today, and its implications for settlement.

In particular, some of our callers have expressed these concerns:

1) Energy users (providing demand-side response) have expressed concern that the incentive that was there for them to turn off in the 12:00 trading interval is no longer there (in retrospect) but that the incentive for them to turn on and consume as much as possible in the 12:30 trading interval has remained – though they might have made the decision to stay offline because of uncertainty surrounding prices in that period.

2) It’s a similar concern for peaking generators, who would have started at 11:46 (in response to the 11:50 dispatch price) and hence incurred running costs for a return that evaporated – with the effect magnified (if they continued into the 12:30 trading interval) because they have to pay AEMO for the energy they produced in that following 30-minute period.

More about this later, if I have the time…

PS – today the AEMO has published this communication to explain yesterday’s interesting events:

I will look forward to seeing the final report – and (if time permits) will post it here as well.

In case you were curious, these notes are normally copyright & confidential AEMO, so I ran this past Brian and he said it was ok.