In an earlier article for WattClarity, I explored how retailers hedge, so I thought I would examine the flipside of this, in how generators usually hedge. Firstly, it is important to realise that what I present here is representative of usual practice, but this does not preclude a generator from taking alternative means of hedging, or no hedging at all. It is also important to understand that the National Electricity Market (NEM) is an energy only market, which encourages consumers of energy to contract to minimise the risk of exposure to high spot market prices and conversely, encourages generators to contract to minimise the risk of extended periods of low spot prices.

Market Design

The NEM is a “gross-pool,” “energy only” market, which means the following:

- All generation must be bid into the market.

- All generation and consumption must be settled through the market.

- Market participants only pay or receive revenue for when they consume or generate energy.

- Generators do not receive any direct capacity payments from the energy market.

A key observation of the NEM and similar energy markets like New Zealand is that much of the time when the there is more than sufficient generation to supply the market, prices are usually set at “marginal cost”, which is effectively the cost of fuel for a generator. Generating at marginal cost for a generator is insufficient in the medium to longer term to also cover the fixed costs of a generator such as capital costs, salary costs etc. (arguably, in the long run no costs are fixed but in the timeframe we are considering, these costs cannot be deferred). Conversely, at times of high demand, when generator reserve margins are low or non-existent, spot prices soar to prices that may be an order of magnitude or more above generators’ marginal cost.

The end result of the “gross-pool”, “energy only” market is that both energy retailers and generators face significant risk if they only sell or purchase energy at the spot price. i.e. a retailer that sells energy at a fixed price to its customers may “make hay whilst the suns shines” if it pays the spot price when the market is oversupplied but faces the potential risk of huge losses if prices spike at times of high demand, whilst a generator faces the risk of receiving little or no revenue when spot prices are subdued, which may persist for an extended period of time. Therefore, generators as well as retailers are motivated to provide revenue or cost certainty by contracting.

There are a number of derivatives or financial contracts that can be utilised but the main contracts utilised are swaps and caps. Briefly retouching on these contracts again, as I have done previously for WattClarity.

Swap Contracts

Swap contracts are those that provide price certainty to both buyer and seller, where the buyer is paid by the seller the difference between the spot price and the contract price, when the spot price is higher than the contract price. Conversely, when the spot price is below the contract price, the buyer pays to the seller, the difference between the spot price and the contract price. Effectively, buyer and seller “swap” insurances, i.e. the buyer insures the seller against relatively frequent low prices, and the seller insures the buyer against infrequent but potentially very high prices.

Cap Contracts

A cap contract is essentially just one half of the swap contract, which insures the buyer against prices above the contract or strike price and the seller receives compensation known as premium for providing this insurance. Usually in Australia’s National Electricity Market (NEM), these contracts have a strike price of $300/MWh.

If these concepts need further clarification, I suggest you review the two following articles on WattClarity:

- “How Retailers use contracts to hedge customers” by yours truly; or

- “More on those negative prices, how do contracts affect bidding” by Allan O’Neill

“Baseload” Generation

Historically, “baseload” generation has mainly been largely coal-fired generation that had the following attributes:

- High Capital Cost

- Low Fuel Cost

- Slow to start/shutdown and change output MW (relatively inflexible)

As a “baseload” generator wishes to cover both its fixed and variable costs, and is best suited to running 24/7 operation, a contract that supports a flat load and is sufficient to cover both fixed and variable costs is likely to be a swap. If we consider a hypothetical scenario, with a baseload generator that has $30/MWh of fixed costs and a marginal cost of generation of $20/MWh, mainly representing the cost of fuel (coal), then a swap at $50/MWh is sufficient.

Figure 1 – Baseload generator running almost all year

What this means for a baseload generator is that if the swap price is near your Long-term Cost of Energy (LCOE) then selling swap contracts at close to your rated capacity is a sensible strategy to earn a reliable revenue. As stated in my previous article, a baseload generator (subject to minimum generation levels and flexibility) may choose to alter its output to higher levels when the spot price is above the marginal cost of generation, or conversely reduce output when the spot price is below the marginal cost of generation, both to improve profitability.

Peaking Generation

Peaking Generators usually have the following attributes:

- Lower Capital Cost

- Higher Fuel cost than “base load”

- Relatively fast to start

- May be fuel constrained

Traditionally, this may have been Open Cycle Gas Turbines (OCGT) or even diesel generators. Hydro generators are also often peaking generators but although their build costs are high, their investment horizon and useful life is much longer, so the capital costs per year may also in effect be lower. Therefore, a contract that pays their fixed annual costs and covers their fuel costs when operating is ideal for a peaking generator. A hypothetical example might be as follows. It must be noted that fixed costs should be covered all year, whilst fuel costs only need to be covered when the generator is running, which may typically be 10-20% of the time in the NEM. Therefore, we effectively have two states of operation:

Running at or around full load:

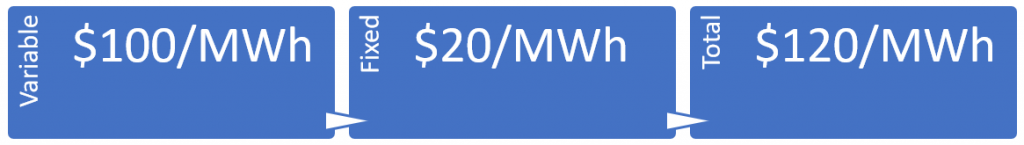

Figure 2 – Theoretical Peaking Generator costs when running

When the generator is off:

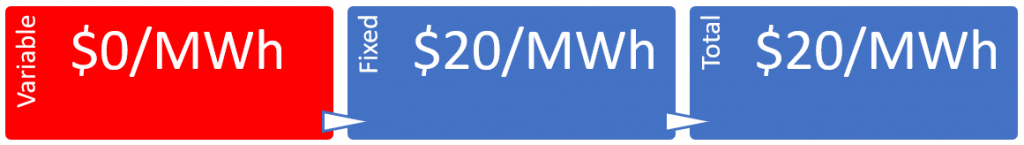

Figure 3 -Theoretical Peaking generator costs when generator is off, where fixed MWh is annual cost/total MWh for 24h-365-day operation

Note: most gas fired peakers have best efficiency at maximum output, so if running, they will usually wish to be at full load to maximise spot market profits

Therefore, if the generator could sell a cap with a premium of $20/MWh and a strike price of $300/MWh under this scenario, it covers its fixed costs and only has to pay out when prices are above $300/MWh. Additionally, as its marginal cost of generation is only $100/MWh, it makes additional profit when the price exceeds $100/MWh. This particularly suits gas fired peakers that pay spot prices for gas, rather than contracting fixed price contracts as they don’t know which days they will be expected to run. These generators can potentially cover their fixed costs and generate only when prices are sufficiently high. Whilst they potentially may give up some profits, they have certainty over a large portion of their revenue by contracting a cap contract.

Mid-merit (Intermediate) Plant

Intermediate plant may have previously been described as “mid-merit” because it is not as cheap as a baseload power station, nor as expensive as a peaker. This was usually because Closed Cycle Gas Turbines would supply this part of the market and consume natural gas with greater efficiency than a peaker as they capture some of the waste heat from the gas turbine and normally use this to power a steam turbine. This plant is usually more flexible than a baseload generator but not as flexible as a peaker. This type of generator may only contract for a few months at a time, or alternatively it may only sell peak swap contracts that operate from 7am to 10pm on working weekdays.

Variable or Intermittent Plant

Renewable generation is often labelled as variable or intermittent as its generation at any future point in time is uncertain as it relies on the availability of solar or wind resources. Most owners of these plants prefer to contract a Power Purchase Agreement (PPA), which is actually a swap contract with a fixed price but with variable volume. We could assume that a wind farm might have maintenance cost per MWh for the wear and tear on turbines when used, but a solar farm might well be considered as a capital investment where the annual operating costs are also considered to be fixed as they occur regardless of the generation output i.e. staff, cutting the grass, cleaning panels etc. In this instance, we may consider the variable costs to be zero, so the revenue needed per MWh that is required is simply enough to cover the investment, interest costs and earn an economic profit. If we assume that an adequate price is $50/MWh, then our revenue requirements can be displayed as in figure 4.

Figure 4 – Renewable Generator Revenue requirements

Generation Business Contracting Policies

Generation companies will usually have a risk management policy that stipulates rules that may include:

- Types of contracts that may be utilised i.e. swaps, caps, futures etc.

- Counterparties that can be traded with

- Levels of contracts and the times at which contracts can be entered into against generation assets. This may be affected by the number of generation units, dam levels, contracted fuel supply, maintenance and other factors.

As a potential example, a baseload generation business might only be able to trade swaps, with counterparties of reasonable credit quality and may only be able to contract the full output of 3 of its 4 generators* subject to sufficient coal contracts.

*n-1 contracting: it is often suggested that a “safe” contracting level for a generation company is to contract all of its units, except output equal to its largest contracted generating unit to cover the possibility of an unplanned outage. Whilst this is plausible, often there may only be 1 or 2 units, so often short-term contracts such as caps may be purchased by baseload generators to manage maintenance downtime whilst some peakers such as gas turbines can manage to do short duration maintenance in shoulder periods when energy market demand is low.

Within the constraints of the risk management policy, it would be expected that the organisation gives its trading team some latitude in the level and timing of the contracting. i.e. a policy might stipulate something like the following in table 1, where the final contract level is decided based upon their view of the of expected spot prices versus market contract prices.

| Hedging Level | Current Period | 3 to 12 months | 1-2 years | 2-3 years |

| Minimum | 60 % | 50 % | 40% | 20% |

| Maximum | 100% | 100 % | 70% | 60% |

Table 1 – Potential hedging limits

Further Contracting Choices

It should be noted that the hedging arrangements here are representative and you could reasonably expect that many generation companies would hedge in this manner. Conversely, it is also possible that a baseload generator might be selling caps or even a peaking generator could be selling swaps, provided that it is sanctioned by the risk management policy and the business believed it represented a more attractive commercial proposition at a point in time. Generators may also purchase hedges when prices are low in anticipation of future price rises or to reduce their contracted position to realise a profit or manage expected outages.

There are other contracts, particularly options over swaps or caps that may be employed and we’re not going to describe all contracting opportunities available in this article. As an example, a frequently traded contract is often be a “swaption” which is either of an option to buy or to sell a swap contract at an agreed price. i.e. if you’re a generator wanting to take advantage of future high market prices say 1 to 2 years out but are uncertain if your maintenance will be finished at that time you could buy a put option that enables you to sell a swap contract at an agreed price anytime from now until the final exercise date. Your premium is paid to the seller and the swap is only invoked if you exercise the option. This effectively buys you an insurance against the risk of wholesale prices falling, whilst not committing your generation.

Concluding remarks

Most generators hedge much of their capacity and this varies from business to business. Many of these contracts entered into are swaps or caps but other contracting choices are available.

It should also be observed that whilst a baseload generator would like to cover its LCOE with swaps and that a peaking generator would ideally like to have the cap premium pay its fixed costs, the market prices available reflect the relative scarcity of these financial products and are not guaranteed to be sufficient in the long term. At times during the history of the NEM, contract prices may have been viewed as insufficient for an economic return on generation and this may have been caused by a number of factors including initial over investment in capacity and non-market arrangements such as vesting contracts put in place by state governments in the transition to competitive markets.

I hope this article assists in understanding some of the contracting of generators in the NEM.

——————————————-

About our Guest Author

|

Warwick Forster is an experienced energy professional with 20 years of experience covering energy trading, risk management, market operations, retailing, pricing, renewable project development and energy storage.

He is now an independent energy markets consultant operating through the business, Apogee Energy. You find Warwick on on LinkedIn, and Twitter.

|

Posted this on Allan’s ‘negative prices’ piece, repeating it here. Could we perhaps have a think piece on renewable PPA’s from the point of view of the buyer, particularly a gentailer buyer? Renewables are increasingly achieving low NEM prices as their weight in the bid stack increases. To make this worse, I suspect that correlation is rising as geographical dispersion of assets falls. The PPA buyer is paying a fixed price for variable volume, and will frequently have been better off just taking spot – perhaps one reason for large hedge expenses booked by AGL and Origin. So what exactly is the point of a PPA for the buyer? If PPA buyers start to get cold feet, could it make it harder for new projects to get financing?