Some of this content was originally posted in this article on 8th November 2019 “3rd Case Study – Tailem Bend Solar Farm in SA Region on Wednesday 6th November 2019” – but will be updated and extended here as time permits.

—

(A) Why can spot prices drop below $0/MWh in the National Electricity Market?

In the Glossary we’re progressively building this page to link together different content prepared to explain how dispatch works, and how prices are set in the NEM.

Negative prices signify a surplus of generation relative to demand for that interval – and should incentivise either or both of the following actions:

1) Demand to increase, to take advantage of the low cost supply; and

2) Supply to reduce.

(B) How often does this happen?

Negative prices are being experienced at increasing incidence as this energy transition gathers pace.

We posted this article “Longer-term trends of low (and high) dispatch prices in the NEM across all regions” on 31st August 2019 to show how the incidence had been trending to that point in time.

(C) What are the implications for Generators*

* by “generators” we mean supply-side options, which would include:

(a) storage facilities (batteries, and pumped hydro) discharging

(b) and also supply of Negawatts (should they be incorporated into the dispatch process under the rule change discussed here)

When any generator operates during periods when spot prices are negative for the Trading Period (noting the change in trading period from 1st July 2021 with 5-Minute Settlement), there is some party that will end up paying AEMO for the MWh produced during that period.

Specifics of who pays this cost do vary depending on the nature of the commercial arrangements in place for that particular generation site.

(D) How can Generators manage Negative Prices

It’s mentioned a number of times in different media (like in this Case Study) that generators “switch off” to avoid negative prices. It is crucial for everyone to keep in mind the following very clear distinction between two very different types of generators:

| Generator Type #1

Scheduled, and Semi-Scheduled Generators |

Generator Type #2

Non-Scheduled Generators, |

| With these plant the most important thing for readers to understand is that they cannot simply switch off when they don’t like the price they are getting.

[well, actually, we did find this example here where it appears one wind farm did that – and have found other examples as well – but my point is that this is not what should be happening, according to my understanding of the Rules] There’s a good reason for this – in that it would make the AEMO’s job impossible to do (in terms of balancing supply with demand to keep the lights on) if everyone did what they wanted. Instead, generators that are Semi-Scheduled and Scheduled need to try to achieve the outcomes they want via the Bidding and Dispatch Process.

|

Below a certain threshold the rules currently assume a lower level of sophistication amongst smaller generators – and a lower collective impact on balancing supply/demand.

They are, in effect, allowed to “do what they want” by switching off if they don’t like what the price is for the region they are supplying into. This leeway, coupled with the fact that the AEMO also sometimes won’t even have visibility of these generators, does have the potential (when adding up across an increasing number of suppliers who are similarly incentivised) to make the AEMO’s Primary Role of ‘keeping the lights on’ a whole lot more difficult into the future. In our Generator Report Card 2018, we included discussion (Theme 13 in Part 2 – What’s the future for Participation Categories in the NEM?) about the future implications of this leeway (amongst other things). |

The main point, here, is that we all need to be quite clear which category a “generator” (i.e. a supply-side option) fits into, as the way they are treated is very different!

We extend the table above to think about which price trigger to use – nothing is as simple as it might initially seem in the NEM, as there are multiple price triggers (including the following):

| Generator Type #1

Scheduled, and Semi-Scheduled Generators |

Generator Type #2

Non-Scheduled Generators, |

| Generators in this group need to recognise that there are essentially two main prices that they need to be aware of simultaneously:

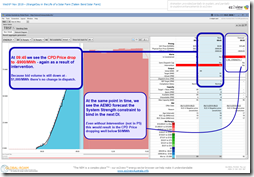

Price Type A = what they will be paid: A1) which includes all of the complications noted for the Non-Scheduled generators in the second column A2) this is coupled with the fact that (because the generators are larger in this type) the implications of producing at times of negative prices can be much more expensive. Price Type B = what they are dispatched on. B1) It’s important to note that this is a different price. B2) In our animations, it is shown as the CPD Price (visible in ez2view), and the way that it is formed is quite complex (and depends on whether there is Intervention, and whether there is Constraint). These differences were very clear in the 09:45 dispatch interval highlighted below, where the dispatch price for 9:45 was $0/MWh but the CPD price was so much lower – and (at the same time) the forecast CPD price for 09:50 was also likely to be so much lower than the dispatch price but for a different reason. Contact us (+61 7 3368 4064 or this form) if you need to know more about this… What complicates this further is that Scheduled and Semi-Scheduled generators are given targets by NEMDE based on bids they must place in advance of dispatch. Hence some added layers of complexity in trying to achieve outcomes that a generator might be happy with. |

Until 1st July 2021 (when 5 Minute Settlement begins) the NEM operates with 5 minute dispatch and 30 minute settlement.

This presents a number of different implications for different parties. For spot-exposed, non-scheduled generators, it adds complexity to their operations even when they can “run when they want”. The main reason for that is that the actual price they will be paid for energy generated in a half-hour will only be known*, in reality, about 26 minutes into a 30-minute trading period: * and even then, on occasions, prices can be revised. For many of our 20 years of operations we have worked with suppliers in this space to help them understand how to lower the risks inherent in this process. In contrast, we’ve seen what appears to be some pretty clumsy attempts to cope with this (in terms of negative prices) with other generators recently, and we’ve heard of others more directly – food for other Case Studies? We already have a number of smaller solar farms as clients where our data feed triggers “turn off” signals for them in their control systems onsite, to curtail production at times of negative prices. Some have been operating for quite a while. Contact us (+61 7 3368 4064 or this form) if you need to know more about this… |

The main point, here, is that there is some considerable complexity involved in interpreting the data published by the AEMO. You need to ensure you’re looking at the right data (as the animation above shows, there can be a large difference between the Correct and the Incorrect Price!)