As you may be aware, I have tried to ensure that I have been involved at many of the conferences and forums organised by the Energy User’s Association of Australia (EUAA) over the past 10 years or so. Last Wednesday (16th June), the “Energy Price and Market Update” (EPMU) seminar was one such occasion.

I make this effort, as I see that the long-term sustainability of the National Electricity Market (NEM) is very much dependent on energy users being an equal party to the way the NEM operates. I see that this will work to ensure that they are able to secure reliable supplies of competitively priced electricity, and be offered meaningful choice with for value-added services with respect to these supplies.

I see the efforts of organisations such as the EUAA as integral to ensuring that energy users are educated about, and have a voice in, the various changes and other developments progressing in the NEM.

I see our role as playing our part in ensuring that energy users have access to, and understanding of, the relevant NEM data.

On some occasions, I have been able to bring one of more from our software development team along, in order that they have a chance to hear (first-hand) of energy user’s concerns. In more recent times, these developers have even sometimes posted their thoughts online at WattClarity® as a means to accelerate their learning about the concerns and perspectives of energy user concerns.

This post is a further step that we’re taking to ensure that we correctly understand the current (and possible future) concerns of energy users. For in understanding the concerns of energy users, we will be better placed to ensure we continue developing software that is relevant to energy users, as their needs change over time.

Hence, I am most keen to hear if we have overlooked anything significant, or if I have misinterpreted anything?

.

A. Headline issues

My take on the underlying concerns, opportunities and threats for energy users in the NEM can be summarised as follows:

1) It’s feared that Electricity Prices are set to increase

One one level, you could be excused for noting that it’s natural that rising prices would always be a concern – for, on the flip side, I can’t imagine that falling prices would be as much of a concern.

Certainly the vast majority of the speakers at the EPMU, and in other recent events as well, have spoken about their view that prices are going up. However, there were a couple who also spoke of factors occurring that are putting downward pressure on prices (at least in the short term).

Given that an energy user’s cost of electricity purchase is made up of several components, I have tried to unbundle my summary in the section below.

But first to some other concerns…

2) Customer choice is declining

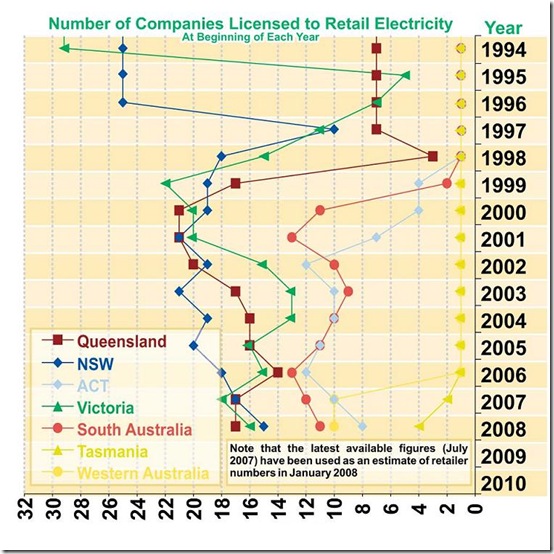

In the early days of the NEM, and even pre-NEM, there were a large number of retailers formed from the distribution boards that existed prior to the market being established. This number has been declining since these early days.

I haven’t seen Carl Daley’s “Pac Man diagram” for a few years, now – here’s how we show this trend in the 2007 Issue of the “Power Trading Schematic” Market Map:

If we continued the trend over the past few years, we would see how the retailer numbers have continued to decline.

Furthermore, it has been noted (by speakers and delegates) that several things have been happening:

(a) That some of the licensed retailers are more interested in residential customers than in energy users in the large Commercial & Industrial space;

(b) The planned privatisation in NSW is also of concern:

i. It’s a widely held belief that at least two of these retailers will disappear, post privatisation – with the 3rd (Integral-Eraring) being the subject of the stated intent of the government to float via an IPO if an independent bidder did not emerge.

ii. In the meantime, it’s been noted that these 3 retailers are much less active in trying to win new business than was the case several years previously. The uncertainty affecting their business would not be helping any attempts they might want to make to grow.

All of this means that large C&I customers are finding the need to be much more active in enticing retailers to tender for their business.

One worthwhile development has been the emergence of ERM Power Retail as a new retail business specifically focused on the C&I sector of the market. Their CEO (Mitch Anderson) spoke at the EPMU.

3) Retailer differentiation is slow to emerge

Coupled with the above, it still is difficult for me to see the differentiation between a number of the major retailers in the market seeking to serve C&I clients.

As noted above, ERM Power has built a business specifically focusing on C&I, whilst others (Momentum Energy, Victoria Electricity, Our Neighbourhood Energy, etc) seem to be more focused on the smaller sized customers.

However, the point of differentiation between Origin Energy, AGL Energy and TRUenergy is not clear to me.

4) Reform is stalled, and Leadership is missing

There have been a number of references made to the fact that government-instigated reviews – like the Parer Review (final report published in December 2002) and the ERIG Review (final report published in January 2007) have come and gone, with many of the recommendations made in these reviews not really being adopted through the MCE and implemented.

This has been linked (by some) to a lack of leadership shown at a policy level within the Ministerial Council of Energy.

5) Conflicts of interest are stalling competitive outcomes

There are continuing claims that government ownership of assets in QLD and NSW is continuing to distort market outcomes.

The topic causing most concern at present is the role that government ownership of DNSPs and TNSPs in NSW and QLD might be playing in the apparent discrepancy between regulatory determinations made in the AER’s Revenue Reset processes for these businesses.

More about this below…

6) Policy uncertainty has not gone away

A number of people still profess to a view that a carbon price will still come, eventually.

Reports (such as this one recently in the AFR) that the government might be considering a consumption-based ETS, as opposed to the production-based ETS, only feed this uncertainty. It may well be that this would be a more effective mechanism of achieving the policy objectives, but (in the period it is being considered) it will continue to add to the current uncertainty.

The ongoing changes to the renewable energy scheme is another area of uncertainty that energy users are trying to grapple with.

Added to the mix, as well, is the possible impacts of the mooted Resources Super Profits Tax (whether, and however, such a scheme might actually been implemented) and it’s fair to say that no sector in the energy supply chain has a clear picture of what the situation will be in 2010 (or even 2012).

7) Capital Investment Required in the NEM is staggering

SUPPLEMENTARY COMMENT 21st July 2010

The commentary that was originally posted here has been moved to this separate post here, in order that it can be linked to directly, and further developed over time.

When significant new commentary has been added to this article, it will be denoted as such.

8) Structural change in the economy could be coming

One conclusion that could possibly be drawn from the issues above is that it is likely that a number of large energy users might downsize their operations in Australia (or leave completely) if these issues are not addressed.

9) Energy Users have found new ways of purchasing

Through all of these changes, it has emerged that an small but increasing number of energy users are considering different ways of purchasing energy.

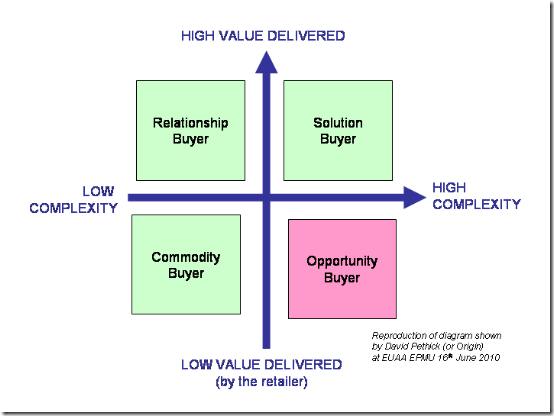

David Pethick of Origin Energy summed it up well in his presentation at the EPMU, when he drew a diagram showing 4 different types of buyers.

I thought that this framework represented the strategic choices available to energy users so well that I have (correctly, I hope) re-produced the diagram below:

I’ll explain a little more about each type of buyer below….

Through the course of these EUAA events, a number of consultants have been called on to provide their own views of where the market is headed, and what steps the energy users might take to secure the best arrangements. In making these presentations, it has appeared (to me, at least) that each consulting company seems to concentrate their efforts on companies operating within one, or perhaps 2, of the segments indicated above.

In the interests trying to provide more clarity to the reader, I have attempted to slot these consultants in the segment of the matrix where their efforts (to me) appear to be focused. If I have made any errors in doing this, I do apologise – if I have done, please contact me to clarify and I will include your clarification in this post:

(a) Commodity Buyer

This type of buyer still purchases the “traditional” way, which could be described (in shorthand) as follows:

Some time (perhaps 6 months) before their current contract expires, the energy user would line up a range of retailers and ask them to quote on a renewal of their purchase, for a fixed duration (which might be 1 year, 2 years or 3 years). Then, select the lowest price, award the tender, then put the new contract back in the drawer and wait another couple of years, before repeating the process.

David indicated (in answer to a question from the floor) that a large majority of energy users still purchase in this manner. It was implied that the percentage is declining, albeit slowly.

Based on the presentations provided by consultants at the last few events, it appears to me that Key Energy (Mark Searle spoke at the Tasmanian Forum, as he has at numerous forums beforehand) and Energetics (Roger Horwood spoke at the EPMU, whilst Grant Raja spoke in Brisbane beforehand) are predominantly focused at these types of clients.

(b) Relationship Buyer

David mentioned that a number of clients choose to partner more closely with a chosen retailer – and then to work in partnership with them to make decisions such as when to time the purchasing of contracts (using such data feeds as prices traded on the SFE as a guide).

At the time when these new contracts kicked in, the energy user’s coverage might look the same (from a practical point of view) but the process of getting there would be:

i. More collaboratively managed; and

ii. Perhaps involve the purchase of “chunks” of cover at different points in time leading up to the start date, depending on how a particular contract is trading.In his presentation, David made it clear that Origin had clients who worked in this manner (indeed, he seemed keen on this idea) and Mitch Anderson (at ERM) also indicated that they worked with clients in this way.

In this type of purchasing arrangement, the requirement for the energy user to have a consultant advising them would seem to be diminished (though perhaps not entirely averted).

(c) Solution Buyers

This type of buyer would be one who views their electricity purchasing not as a traditional commodity purchasing function, but moreso as a treasury (risk management) function.

Approaches taken by this type of buyer might involve different permutations of spot price exposure (with physical hedge, in the form of curtailment – or with financial hedges, such as caps) and financial market contracting strategies.

David noted that Origin had a product specifically for this type of contract, which he called the “Flexible Purchasing Product (FPP)”. Similarly, Mitch Anderson noted that they also offered a similar service (which I think, from memory, was called “Strategic Timing of Energy Purchases (STEP)”. More acronyms!

Based on the presentations provided by at numerous EUAA events, including this one, it appears to me that this is the type of energy user that Creative Energy Solutions (Carl Daley spoke in Melbourne, and Brian Morris in Hobart) is working to serve.

In his presentations, Carl has made the comment that an increasing number of energy users are considering these more complex, but potentially higher-value, methods of electricity purchasing. This couples with our experience, for we supply our deSide® software to energy users who’ve adopted spot price exposure with physical curtailment to manage risk.

(d) Opportunity Buyer

David mentioned the specific case of gas purchasers who were able to sign up as off-takers for initial CSG supplies in QLD around 2004-2005 as examples of opportunity buyers. From a project point of view, the CSG developers were in need of such customers in order that they could prove up their reserves, and offered attractive arrangements to clients who signed up at the time.

David postulated that there may be the potential for energy users to do a similar thing in NSW at the present point in time – with the need for new base-load capacity much talked about, but with little action forthcoming because of (amongst other reasons) insufficient customer volume to underwrite such a plant.

I would couple David’s point with a point I made in early 2008 (with respect to the privatisation in NSW that was being considered way back then) that it might be possible for a consortium of energy users to purchase one of the development sites that’s being mooted for sale by the NSW governments, and then proceed to underwrite the development of new plant on the site.

10) Training is now available for energy users

It’s been apparent to me for some time that there was an opportunity in the market.

The AEMO has, for many years, offered training about the NEM in 4 courses in what they call their “NEM Education Program”.

Unfortunately for energy users (and others who are not direct wholesale market participants), these courses are provided for (wholesale) market participants only. Whilst I support this approach (as the AEMO is a not-for-profit entity), it has left a gap in the market for other market observers seeking to understand more of the NEM.

Beginning in July, the EUAA and Energetics have teamed up to provide this training – with details about this provided on the EUAA Website (I could not easily find a similar link on the Energetics site).

B. Components of an energy bill

As noted above, many of the speakers at EUAA recent events have voiced concerns that the costs of electricity to energy users are increasing.

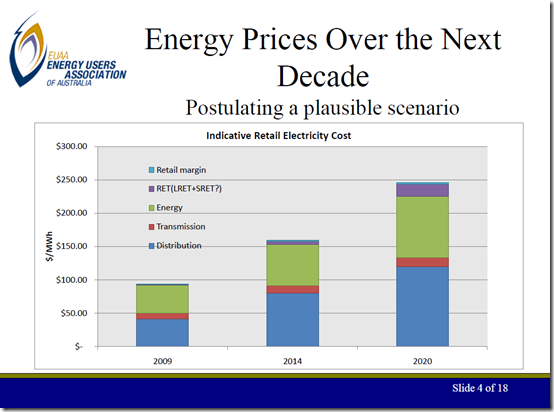

Certainly it’s clear that there are upward pressures on electricity prices – and the EUAA is not alone in voicing concerns such as these (for example, Origin Energy CEO, Grant King, was reported in the Australian as making similar claims at a CEDA conference back in April). At the EPMU, Roman Domanski (of the EUAA) presented this slide to explain the concern of the members of EUAA.

It only shows one possible scenario, and the ultimate outcome will inevitably be different to some degree, but it does indicate the magnitude of the concern.

In looking at the pricing of the energy component of an electricity bill, it’s important to note that the price an energy user pays is a bundle of several different components, each of which has their own drivers. In the interests of clarity, and objectivity, I have summarised my recollection of the various drivers (up and down) that have been referenced as influencers to the price of electricity by various speakers at recent EUAA events.

I have provided these comments with reference to the unbundled components of an energy user’s electricity bill (below).

1) Wholesale Energy

When some people speak about the “cost of electricity”, this is what they might be referring to. However, it is only one component of an energy user’s bill.

Depending on their size and location (and which year we are talking about) the wholesale cost of energy will generally represent something like 50-60% of the overall cost of energy paid by energy users.

(a) in the Physical Market

The NEM is what is termed as a “gross pool” – meaning that all energy needs to be dispatched by AEMO, the central market operator. This physical market is called a number of things by different people (e.g. “pool”, “spot market”, “balancing market” etc) – all these terms mean the same thing, in the context of the NEM.

SUPPLEMENTARY COMMENT 24th AUGUST 2010I’ve recently added these comments here about the various factors driving prices higher (or softening prices, as the case may be) in the spot market, in order to extend on this analysis.

(b) in the Financial Market

As noted above, all power is physically dispatched by, and traded through, the AEMO. This spot market is one of the most volatile commodity markets in the world.

To provide all market participants with opportunities to hedge the risks inherent in trading, a number of financial markets have evolved to provide this facility. These typically take one of three forms:

i. Participants sometimes have long-term bilateral contracts in place in the form of Power Purchase Agreements (PPAs). These tend to be for large blocks of load, for long periods, and to have no price transparency.

ii. In shorter time periods, participants have utilised the services of a number of brokers operating in the NEM to facilitate “over the counter” (OTC) contracting for shorter periods. Because of the natures of these arrangements, there is also low transparency (more broadly in the market) about the volumes traded OTC, or the prices paid.

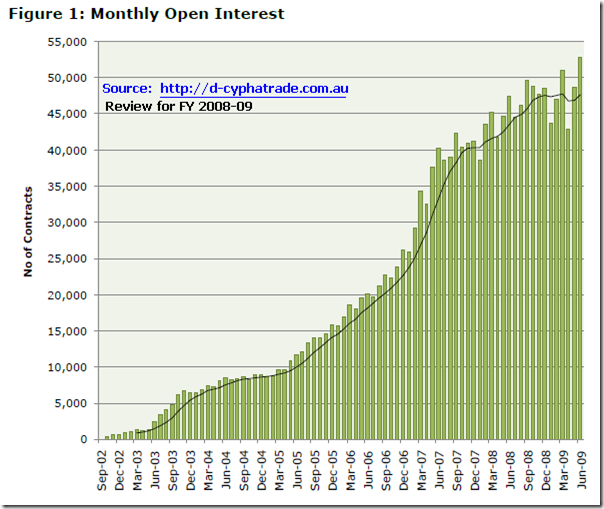

iii. Since 2002, trading of electricity futures contracts on the SFE has increased steadily, as shown in the chart included below, which has been taken from the “Energy Focus – FY08/09 Review” obtained from the d-cyphaTrade website:

Because of the transparency of trading on the SFE (at least in terms of volumes and prices) it has grown to become generally accepted as the best available proxy for a referencable price of trading across the financial market (though it is not without its limitations).

I am in the process of writing a detailed summary of factors impacting on wholesale financial market prices. When this has been completed, it will be posted at WattClarity, with a link included here.

2) Carbon component of energy

We know that the mooted carbon pollution reduction scheme (CPRS) has been deferred out till at least 2013.

At the EUAA events, the majority (though not unanimous) view seems to be that a carbon price will be implemented eventually – though there is considerable uncertainty about what form it might eventually take, the timing for its introduction, and the extent to which there will be assistance provided to energy intensive industries.

With such uncertainty present surrounding carbon, I will be interested to see what form is eventually determined for the EUAA’s proposed “National Climate Change Seminar” in late August.

3) Distribution Use of System (DUOS) Costs

As Stephen Hurn noted with respect to the Annual Conference last year, distribution pricing is a significant concern for the energy users represented at EUAA events. Typically, distribution costs might represent 40-50% of the total cost of energy paid by an energy user.

Because distribution is a monopoly service, the Distribution Network Service Providers (DNSPs) are licensed to provide distribution services in certain distribution regions (there are a total of 12 of these across the NEM, meaning 12 DNSPs).

The National Electricity Rules (NER) provide for the Australian Energy Regulator (AER) to periodically (every 5 years) review both CAPEX and OPEX proposals submitted by each DNSP individually, with a view to determining what’s a prudent amount of investment, given the dual objectives of ensuring security of supply whilst, at the same time, optimising the cost of providing these services over the regulatory revenue reset period.

The process adopted by the AER to review these decisions is complex, and is discussed in a (to be) linked post.

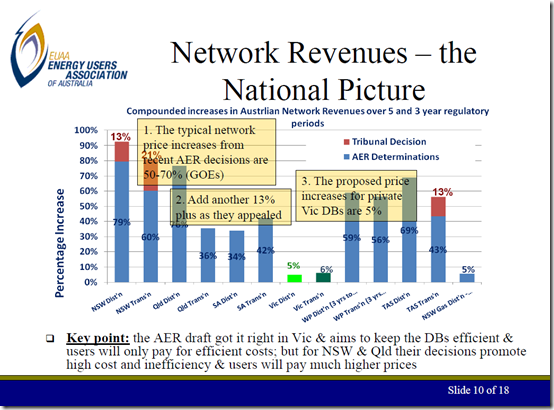

The headline result that concerns energy users is that considerable increases in distribution charges have been approved recently by the AER. These were summarised in the following slide, presented by Roman Domanski of the EUAA at the EPMU:

Results for VIC distribution and transmission are shown in green, as they are only the increases proposed recently by the AER at the draft report stage of the deliberation process.

There have been a number of concerns voiced with respect to these charges. I am in the process of writing a detailed summary of factors impacting on pricing for TUOS and DUOS. When this has been completed, it will be posted at WattClarity, with a link included here.

4) Transmission Use of System (TUOS) Costs

Transmission in the NEM is regulated in a similar manner to distribution.

As a result, the concerns energy users have expressed with respect to the approved increases in distribution costs, moving forwards, are also of concern with respect to TUOS charges.

However, because the scale of the networks is significantly smaller, the magnitude of the costs involved are significantly smaller. As such, transmission costs account for something like 5-10% of the total cost of energy paid by an energy user.

I am in the process of writing a detailed summary of factors impacting on pricing for TUOS and DUOS. When this has been completed, it will be posted at WattClarity, with a link included here.

5) RECs

In the absence of a CPRS, or similar measure, it was noted by many people that an increased focus is being placed on the Mandatory Renewable Energy Target (MRET).

Currently the percentage of energy sources from new renewable resources (i.e. registered with the Office of the Renewable Energy Regulator) is relatively minor (i.e. approximately 2% of the total energy supplied). As such, the cost impost that this imposes on the average large energy user’s bill is relatively minor (2-4%).

However, with the target expanded to be approximately 20% by 2020, the concern has been for a number of years that the cost impost would increase significantly.

However, these concerns have been compounded by uncertainty surrounding the latest attempts to reform the scheme in order to recover from the creation (much above forecasts) of RECs due to the 5-fold deeming of RECs produced in domestic applications of roof-top solar PV installations.

Whilst this has had the desired effect (from the government’s point of view) of supporting an expansion in the volume being installed, it has also had the unforseen and unwanted side-effect of deterring investment in larger-scale, centralised renewable stations, such as wind farms. As such, the MRET is to be split into two different types of schemes:

(a) A Large-Scale Renewable Energy Target (LRET), which will support wind farm development and the like; and

(b) A Small-Scale Renewable Energy Scheme (SRES), which will support roof-top PV and the like.Over successive EUAA events, we have received updates on the developments in this respect, and I note that legislation is being introduced in the current session of parliament.

I am in the process of writing a detailed summary of factors impacting on pricing for RECs. When this has been completed, it will be posted at WattClarity, with a link included here.

D. Locational Issues

The issues raised above are more typical of “whole of NEM” opportunities and threats for energy users. It is worthwhile noting that, on its extremities, there are also a number of other issues that occur on a more localised basis.

These include the following:

1) Tasmania

The EUAA held a “Tasmanian Energy Forum” on Thursday 29th April, which I was able to attend. Unfortunately I did not have the time to post to follow that event.

Tasmania occupies a very unique space within the National Electricity Market for a wide range of reasons, including the following:

(a) It’s generation mix is predominantly hydro-electric, which has a zero short-run marginal cost and hence has more flexibility in terms of how it bids into the market;

(b) This hydro resource is owned by a single generator which supplies the vast majority of the energy generated in the state;

(c) Tasmania is interconnected to Victoria through a DC link that has a transmission capability roughly 1/3 of the total demand in the state – hence changing the direction of flow on Basslink can represent a 70% increase (or decrease) in the amount of generation being supplied by generators in the region;

(d) Over half of the off-peak demand in TAS is constituted by 3 large industrial loads, all of which run fairly constantly, but which have a capacity to provide demand response into the market.

(e) There’s a single incumbent retailer for the state, and few other new entrant retailers. During the event, numerous mentions were made to the fact that, whilst there are 4 existing electricity retailers licensed in Tasmania (Aurora Energy, ERM Retail, TRUenergy and Country Energy), only two of those (Aurora and ERM) are active in pursuing any business.

These factors (and a number of others) mean that the market outcomes achieved in Tasmania have significant differences to those achieved in the mainland regions.

Indeed, it is very interesting to note the reports (in the Examiner and in the Mercury, amongst other places) that the new state government in TAS is to have a fresh look at the nature of competition in the state, in order that they can see what can be done to stimulate sustainable competitive outcomes.

When I find some additional time, I will post about these issues in more detail.

2) North Queensland

Back in November 2009, the EUAA co-hosted a “North Queensland Energy Forum”. From our side, Stephen Hurn was able to attend, and posted this summary of his understandings to follow the event.

Though located at the other end of the market, North Queensland shows some similarities to Tasmania:

(a) The demand in North Queensland is roughly the same as the demand in Tasmania.

(b) It is also interconnected to the rest of the NEM via a large capacity link, relative to the size of the demand (though in the case of NQ the link tends to be more heavily utilised on an ongoing basis, due to a deficit of low-cost generation in the north).

(c) It is supplied gas via a single pipeline from the south, with a few industrial customers signed up to underpin the demand.

(d) It also has a single dominant retailer (Ergon, in this case) with not much in the way of competitive retail offerings (in the case of North Queensland, this is more because of the transmission loss factors at play in the region, which make any competitive offer unattractive to all but the largest of customers, due to the locational subsidies inherent in the tariff structures.

As is the case in Tasmania, concerns have been raised about the nature of prices in NQ, with various options mooted for their reduction, including new baseload generation in the region, or the incorporation of large-scale renewables in conjunction with a transmission connection to the electrically isolated Mt Isa, in the West.

3) South Australia

Completing the triangle, we come to South Australia. We note that the EUAA does not hold any events in South Australia.

Based on our other experiences in this region, we understand that some energy users might share similar feelings to those in TAS and NQ as a result of the lower levels of competition present in the region, and dependence on a large-size link to the main NEM regions (relative to the size of the demand).

well done Paul – an excellent synopsis. You have obviously been paying attention at Roman’s conferences (which I think are very good also). I look forward to reading the next few chapters

cheers Jim

Thanks Jim!

Paul,

A very good start.

One of the big problems with electricity transmission and distribution regulation is the Propose-Respond model that the AER has deveoped and had enshrined in the NEL (I think) whereby the DB’s can put forward whatever they want by way of Capex and Opex and it is up to the regulator to try and determine whether it is valid or not.

Unlike non-monopoly businesses these businesses do not have to demonstrate and capital restraint.

What they seem to do is underspend on capex for the first few years of a 5 year regulatory period, then overspend in the latter years.

They can keep the underspend as an “efficiency gain” and then they get to reset their asset base and recover the over-spend as a P 0 adjustment when the new regulatory period commences.

I believe this is called regulatory gaming.

There has to be a better way.

If users challenge an AER decision then we have to foot a huge legal bill whereas if the DBs do the same they have nothing to lose as any legal costs just get funded by an increase in their Opex which we pay for anyway and on balance they more often than not get a better outcome as the Appeals tribunal has no idea about reality it would seem.

The system is well and truly skewed in favour of the DBs.

Thanks Peter,

I am still trying to get my head around some of the aspects of the concerns you have expressed (plus some others) about the revenue reset process for DNSPs and TNSPs.

It seems to me that, compared to 5 years ago (when it seemed like it was not much of an issue at all) it is certainly top of mind at present.

Paul